As noted yesterday, Stevie Cohen is a target of the FBI/SEC investigation.

Marketwatch is reporting that SAC Capital Advisors LP told investors in a letter that it got a government subpoena, according to a person who received the update from the hedge fund firm.

SAC said in the letter, dated Nov. 23, that the government served identical “extraordinarily broad” subpoenas on a number of investment managers of different sizes and descriptions, including SAC . . . The firm said the subpoenas don’t “shed much light on whom or what the government may be investigating.”

So much for a slow newsweek.

I have no idea how Cohen trades, but the rumors are already pinging around trading desks that where there is smoke, there is fire.

Call me old school, but innocent until proven guilty is still the law. If SAC is found guilty, you can tar and feather them, but until then, I’d rather reserve judgment until the evidence is out there (No, we don’t no any business with them).

~~~

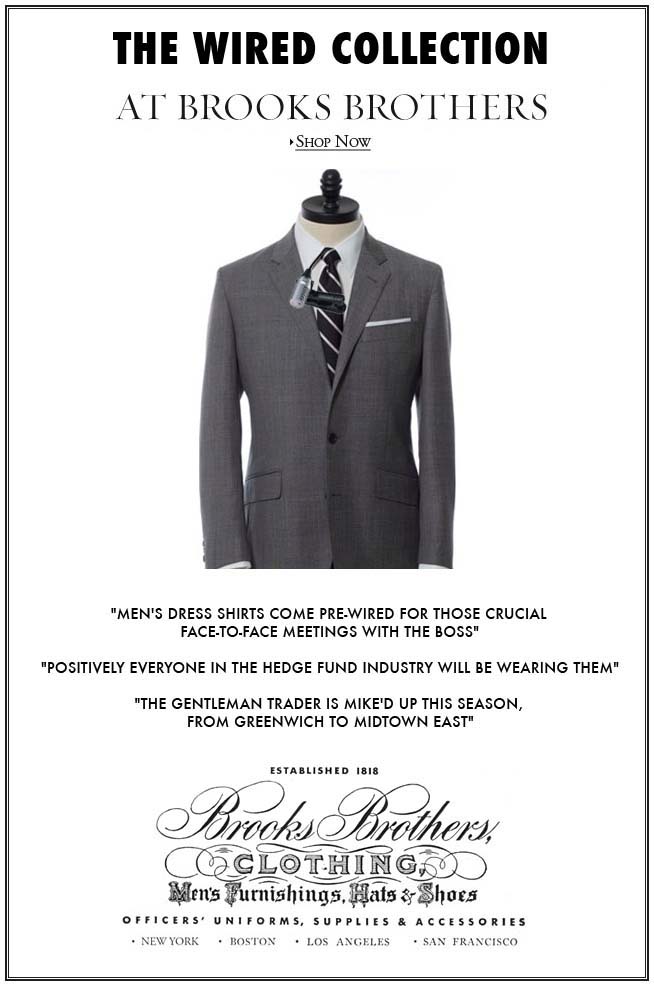

On a less serious note, since the holiday season is about to kick off, for the hedgie on your list, the Brooks Brothers Wired collection is certain to be all the range amongst the 2 and 20 crowd. (Credit: Josh Brown )

What's been said:

Discussions found on the web: