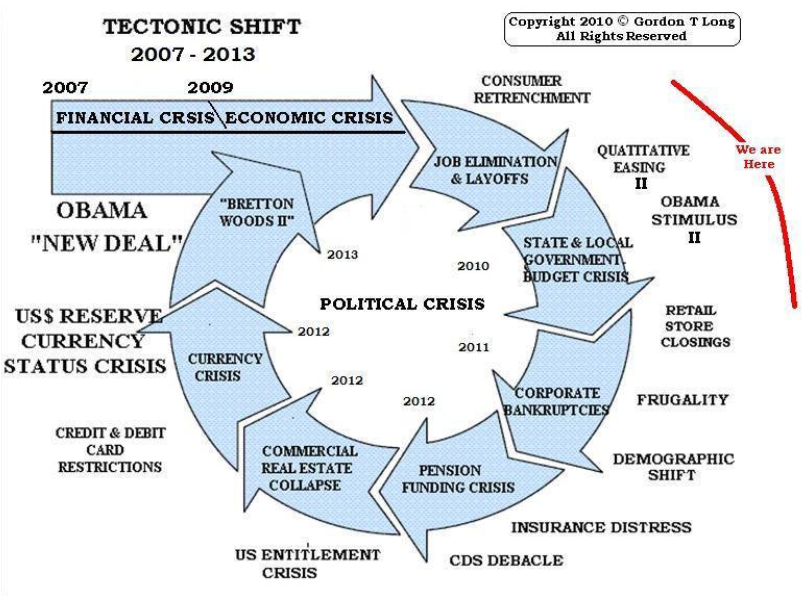

Gordon Long has an interesting graphic on what he describes as the New Economic Cycle.

Quite fascinating . . .

>

Source:

We’ll Need The Courage Of Our Forefathers

The New Economic Cycle

Gordon T. Long

The Automatic Earth, November 8 2010

http://theautomaticearth.blogspot.com/2010/11/november-8-2010-well-need-courage-of.html

What's been said:

Discussions found on the web: