There are forecasts everywhere of better times ahead in terms of employment, retail, inflation, GDP. David Rosenberg is having none of it. He sees the market as heavily propped up by the Fed. This is his look forward for 2011.

~~~

1. In Barron’s look-ahead piece, not one strategist sees the prospect for a market decline. This is called group-think. Moreover, the percentage of brokerage house analysts and economists to raise their 2011 GDP forecasts has risen substantially. Out of 49 economists surveyed, 35 say the U.S. economy will outperform the already upwardly revised GDP forecasts, only 14 say we will underperform. This is capitulation of historical proportions.

The last time S&P yields were around this level was in the summer of 2000, and we know what happened shortly after that.

2. The weekly fund flow data from the ICI showed not only massive outflows, but in aggregate, retail investors withdrew a RECORD net $8.6 billion from bond funds during the week ended December 15 (on top of the $1.7 billion of outflows in the prior week). Maybe now all the bond bears will shut their traps over this “bond-bubble” nonsense.

3. Investors Intelligence now shows the bull share heading up to 58.8% from 55.8% a week ago, and the bear share is up to 20.6% from 20.5%. So bullish sentiment has now reached a new high for the year and is now the highest since 2007 ― just ahead of the market slide.

4. It may pay to have a look at Dow 1929-1949 analog lined up with January 2000. We are getting very close to the May 1940 sell-off when Germany invaded France. As a loyal reader and trusted friend notified us yesterday, “fighting” war may be similar to the sovereign debt war raging in Europe today. (Have a look at the jarring article on page 20 of today’s FT — Germany is not immune to the contagion gripping Europe.)

5. What about the S&P 500 dividend yield, and this comes courtesy of an old pal from Merrill Lynch who is currently an investment advisor. Over the course of 2010, numerous analysts were saying that people must own stocks because the dividend yields will be more than that of the 10-year Treasury. But alas, here we are today with the S&P 500 dividend yield at 2% and the 10-year T-note yield at 3.3%.

From a historical standpoint, the yield on the S&P 500 is very low ― too low, in fact. This smacks of a market top and underscores the point that the market is too optimistic in the sense that investors are willing to forgo yield because they assume that they will get the return via the capital gain. In essence, dividend yields are supposed to be higher than the risk free yield in a fairly valued market because the higher yield is “supposed to” compensate the investor for taking on extra risk. The last time S&P yields were around this level was in the summer of 2000, and we know what happened shortly after that. When the S&P yield gets to its long-term average of 4.35%, maybe even a little higher, then stocks will likely be a long-term buy.

Source: Haver Analytics, Gluskin Sheff

6. The equity market in gold terms has been plummeting for about a decade and will continue to do so. When measured in Federal Reserve Notes, the Dow has done great. But there has been no market recovery when benchmarked against the most reliable currency in the world. Back in 2000, it took over 40oz of gold to buy the Dow; now it takes a little more than 8oz. This is typical of secular bear markets and this ends when the Dow can be bought with less than 2oz of gold. Even then, an undershoot could very well take the ratio to 1:1.

7. As Bob Farrell is clearly indicating in his work, momentum and market breadth have been lacking. The number of stocks in the S&P 500 that are making 52-week highs is declining even though the index continues to make new 52-week highs.

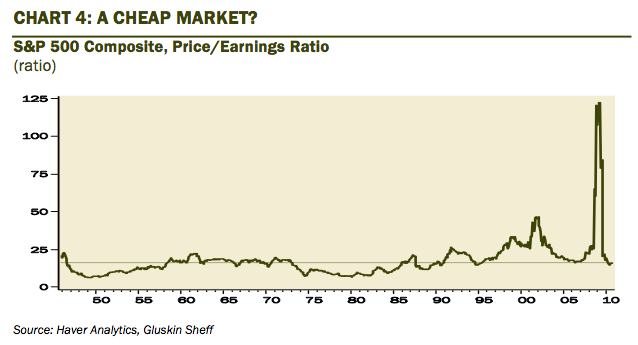

8. Stocks are overvalued at the present levels. For December, the Shiller P/E ratio says stocks are now trading at a whopping 22.7 times earnings! In normal economic periods, the Shiller P/E is between 14 and 16 times earnings. Coming out of the bursting of a credit bubble, the P/E ratio historically is 12. Coming out of a credit bubble of the magnitude we just had, the P/E should be at single digits.

Source: Haver Analytics, Gluskin Sheff

9. The potential for a significant down-leg in home prices is being underestimated. The unsold existing inventory is still 80% above the historical norm, at 3.7 million. And that does not include the ‘shadow’ foreclosed inventory. According to some superb research conducted by the Dallas Fed, completing the mean-reversion process would entail a further 23% decline in real home prices from here. In a near zero percent inflation environment, that is one massive decline in nominal terms. Prices may not hit their ultimate bottom until some point in 2015.

10. Arguably the most understated, yet significant, issue facing both U.S. economy and U.S. markets is the escalating fiscal strains at the state and local government levels, particularly those jurisdictions with uncomfortably high pension liabilities. Have a look at Alabama town shows the cost of neglecting a pension fund on the front page of the NYT as well as Chapter 9 weighed in pension woes on page C1 on WSJ.

Consumer spending was taken down 0.4 of a percentage point to 2.4%, which of course you never would have guessed from those “ripping” retail sales numbers.

In the absence of Chapter 9 declarations or dramatic federal aid, fixing the fiscal problems at lower levels of government is very likely going to require some radical restraint, perhaps even breaking up existing contracts for current retirees and tapping tax payers for additional revenues. The story has some how become lost in all the excitement over the New Tax Deal cobbled together between the White House and the lame duck Congress just a few weeks ago.

What's been said:

Discussions found on the web: