These are some of the more interesting charts that I’ve seen since Friday’s NFP (if you have any suggestions, make them here and I’ll add the best of the lot):

>

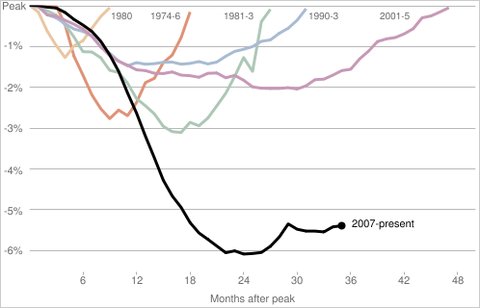

Comparing Recoveries

Courtesy NYT

~~~

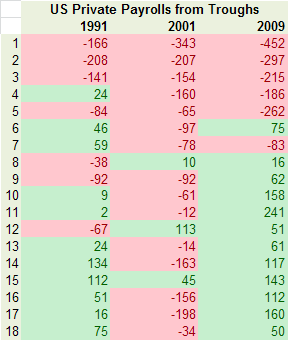

Monthly Payroll Since NBER REcession End

~~~

Temporary Help

via Bruce Steinberg

~~~

Employment Data

Via NYT

~~~

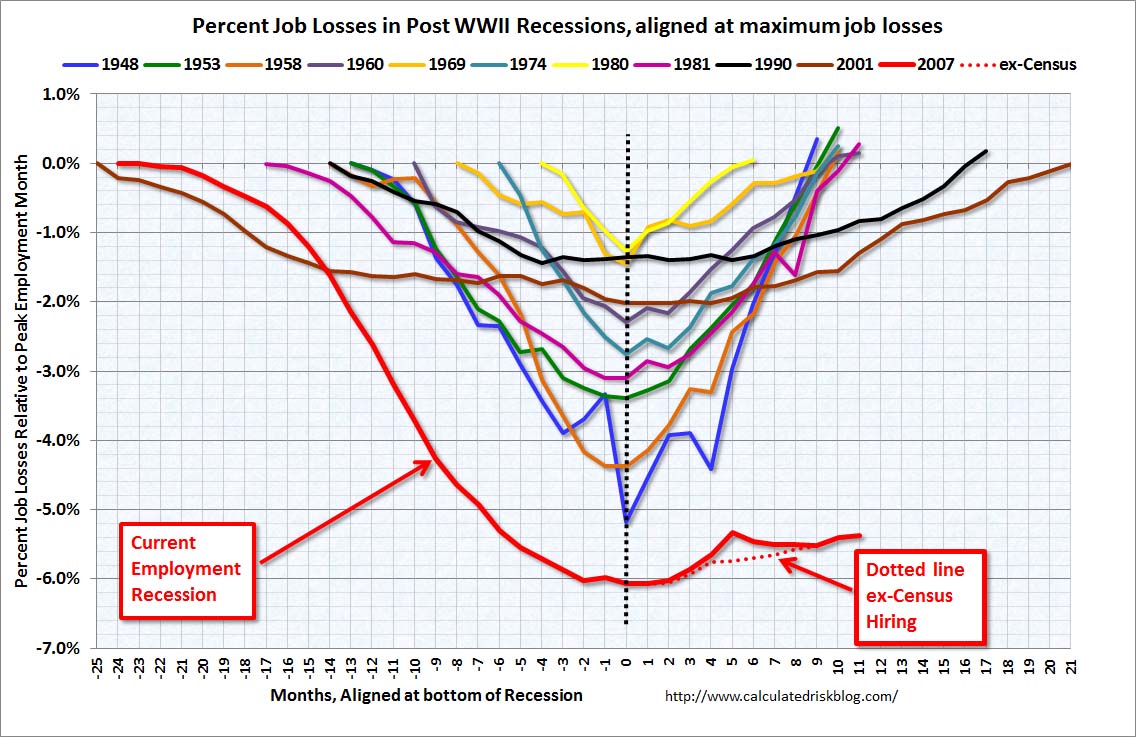

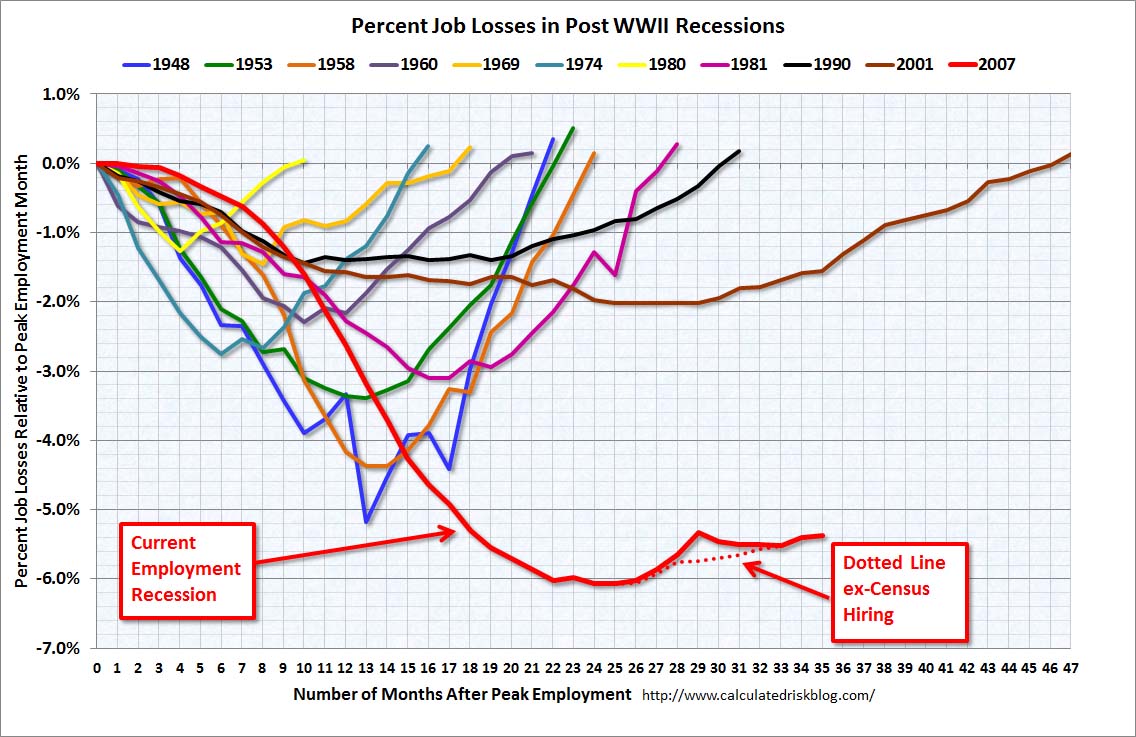

Percentage Job Losses, past Recessions

Via Calculated Risk

~~~

Percentage Change From Recession End

via Chart of the Day

~~~

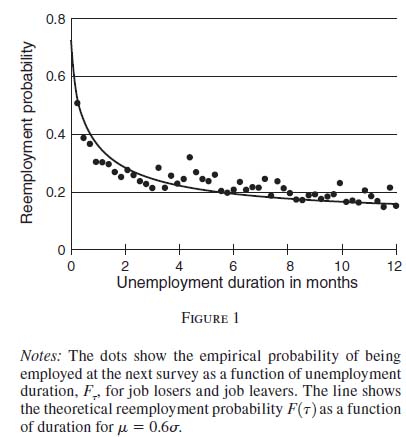

Unemployment Duration (Months)

Via Economix

~~~

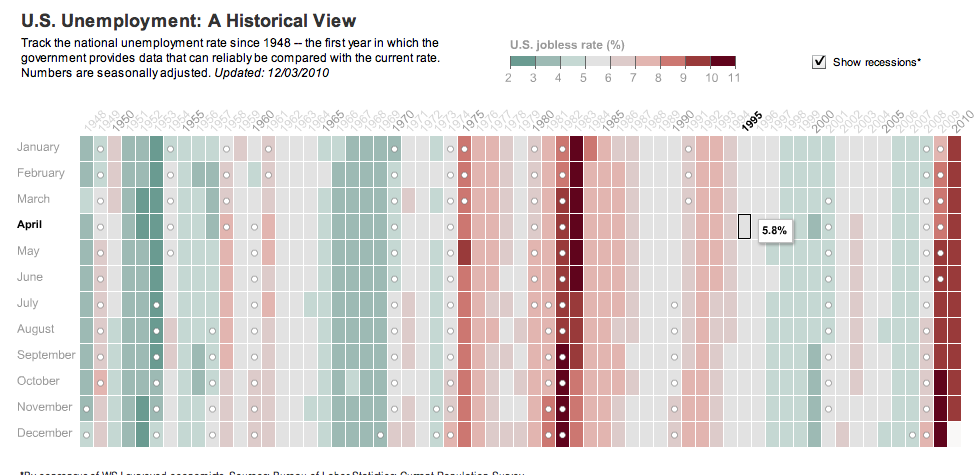

Historical (interactive) Chart

via WSJ

~~~

via Calculated Risk

~~~

Total Private Payrolls

via The Chart Store

~~~

U6 Unemployment Rate

via The Chart Store

What's been said:

Discussions found on the web: