>

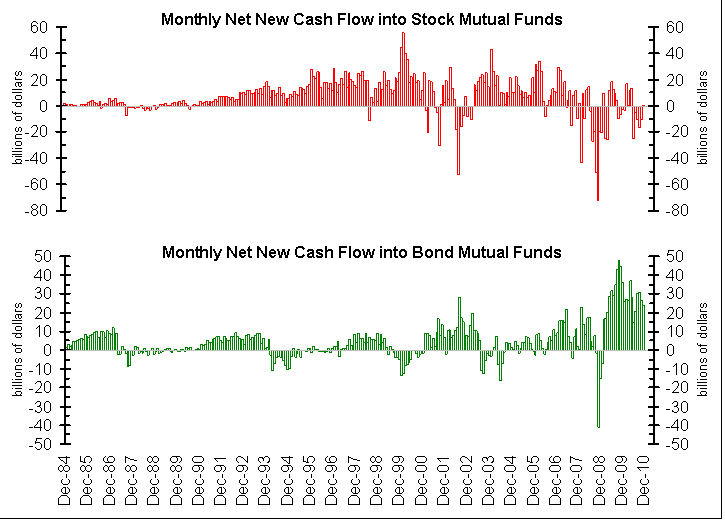

The chart above, courtesy of Bianco Research, gives you a sense of how much enthusiasm there has been for Bonds, at the tail end of a 30 year bull run in fixed income, following the 2008 credit crisis and market collapse.

Note that even after the equity market began to rally, it was still sold off by the public.

What's been said:

Discussions found on the web: