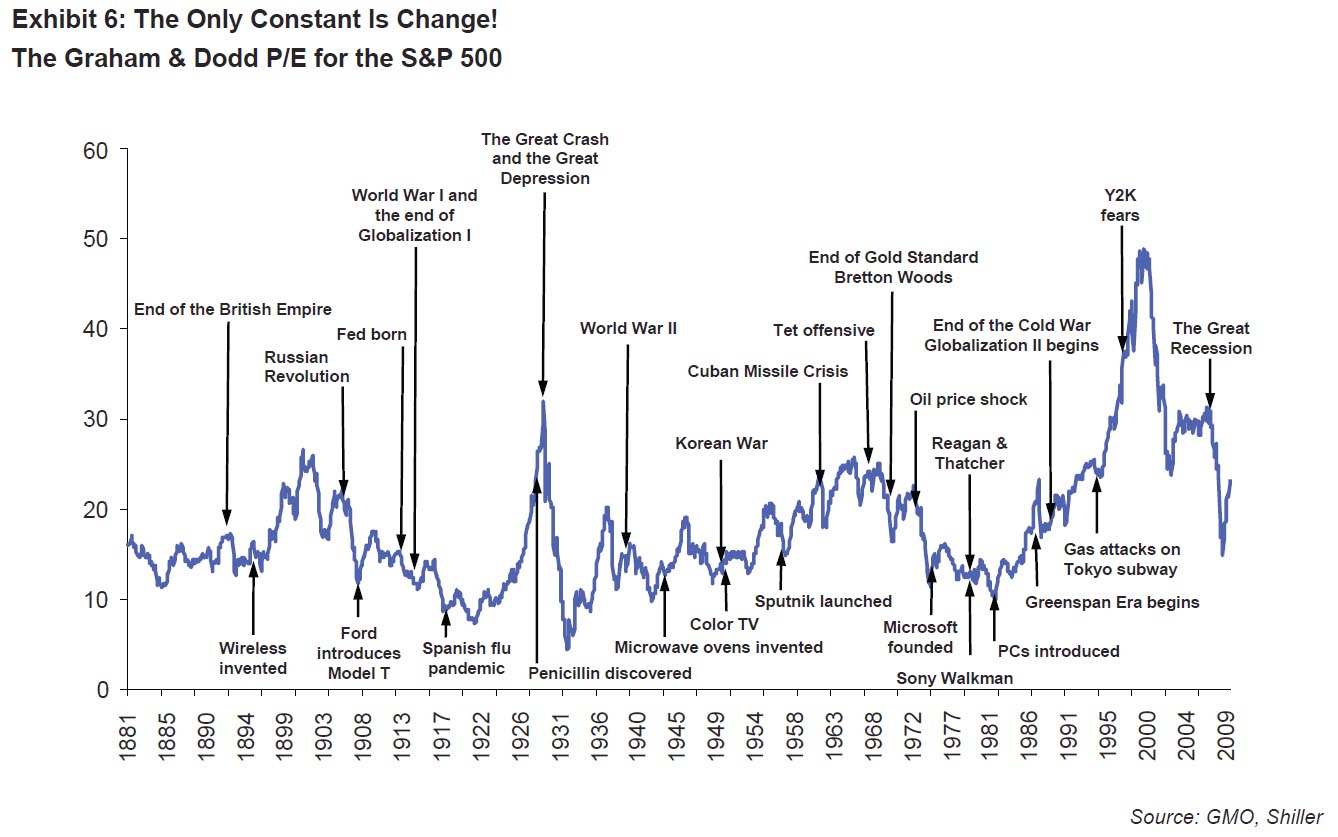

I love this chart from Jame’s Montier’s latest missive, In Defense of the “Old Always.” We learn that major events occur quite regularly, while P/Es fluctuate fairly constantly . . .

>

Graham & Dodd P/E, 1881-2010

>

Source:

In Defense of the “Old Always” (PDF)

James Montier

GMO, 12/22/2010

http://bit.ly/gc7h6m

What's been said:

Discussions found on the web: