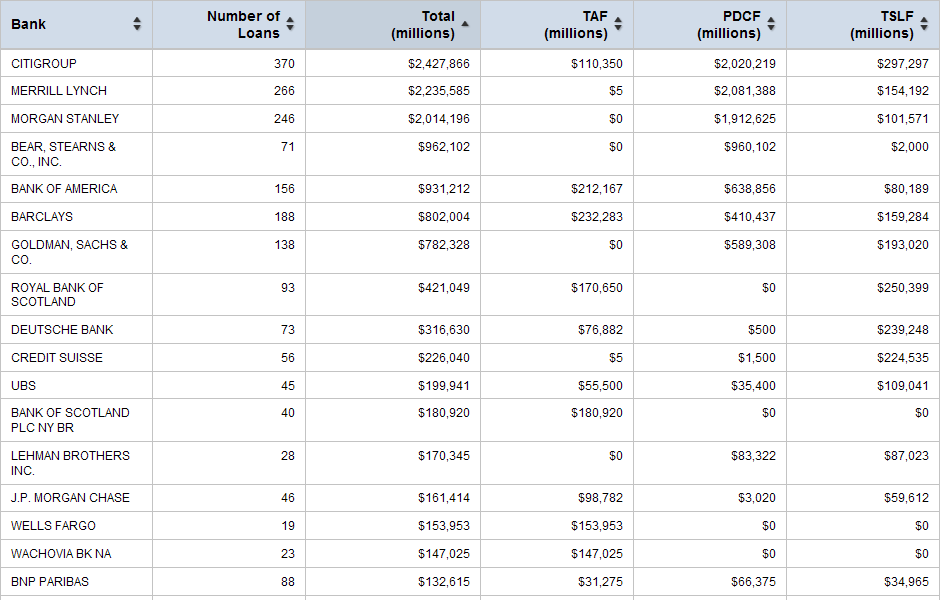

The Fed released detailed data on more than 21,000 loans worth trillions of dollars made through a dozen emergency programs created during the financial crisis.

From Pro Publica’s interactive department: Which Banks Got Emergency Loans from the Fed During the Financial Meltdown?

>

What's been said:

Discussions found on the web: