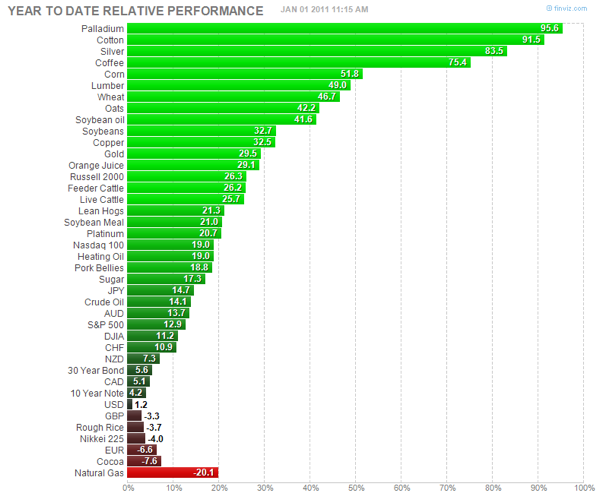

Gold? The hell with that crappy yellow metal — In 2010, it was Palladium (95.6%) and Silver (83.5%) who kicked some butt. So did Cotton, Coffee Corn and Lumber.

Equities are much further down the performance list, with the Russell 2000 gaining 26.3%, the Nasdaq 100 rising 19%, followed by the S&P500’s 12.9%, with the Dow bringing up the rear at 11.2%.

>

Hat tip Paul

What's been said:

Discussions found on the web: