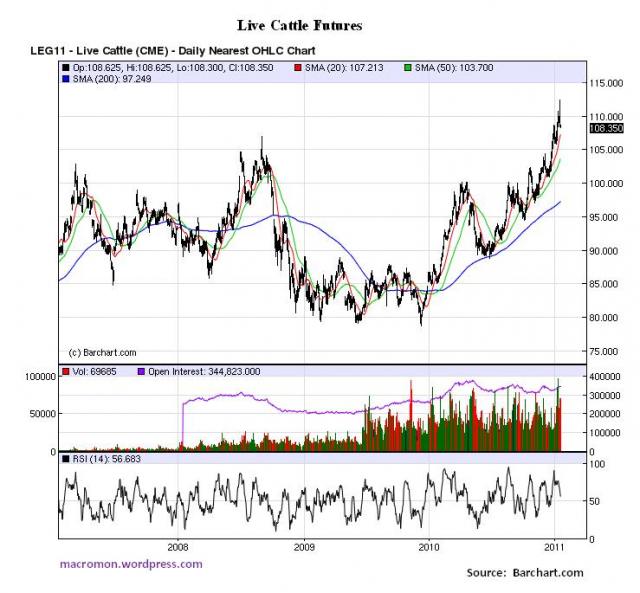

MacroMan points out that Live Cattle Futures have gone parabolic; Daniel Dicker blames speculative derivative traders and a lack of oversight as the cause.

I have no idea what is the underlying driver, but we are now at record prices for Live Cattle Futures — will Beef soon follow?

>

Source: Global Macro Monitor

What's been said:

Discussions found on the web: