>

European governments are preparing to borrow at least $43 billion this week, reflecting deterioration in the sovereign debt story.

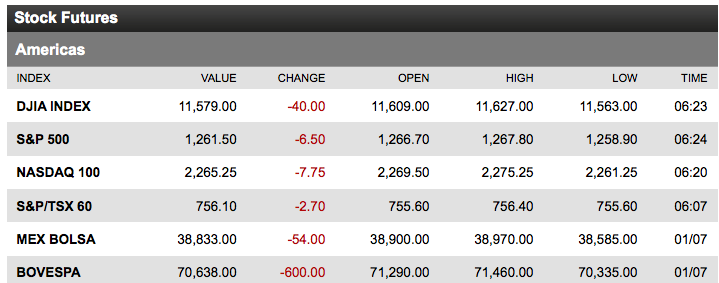

This loan/bailout is pressuring markets around the world; the MSCI World Index lost half a percent, and US Futures, especially SPX futes, are showing modest pressure. Bloomberg reports that the Stoxx Europe 600 Index fell 0.8%, while the Hang Seng lost 1%.

The Street, however, is in the midst of a major rotation, dumping bonds for stocks.Whether its in anticipation of Growth, Inflation, political restraints on the Fed, or some combination of all three is difficult to say. Earnings may be peaking, and could have a hard time maintaining their torrid pace.

Regardless, this rotation has kept a firm bid under equities. It has contained market downside, with markets not falling quite as far as the early morning futures have indicated.

What's been said:

Discussions found on the web: