Raymond James’ P. Arthur Huprich published a terrific list of rules at year’s end. Other than commandment #1, they are in no particular order:

• Commandment #1: “Thou Shall Not Trade Against the Trend.”

• Portfolios heavy with underperforming stocks rarely outperform the stock market!

• There is nothing new on Wall Street. There can’t be because speculation is as old as the hills. Whatever happens in the stock market today has happened before and will happen again, mostly due to human nature.

• Sell when you can, not when you have to.

• Bulls make money, bears make money, and “pigs” get slaughtered.

• We can’t control the stock market. The very best we can do is to try to understand what the stock market is trying to tell us.

• Understanding mass psychology is just as important as understanding fundamentals and economics.

• Learn to take losses quickly, don’t expect to be right all the time, and learn from your mistakes.

• Don’t think you can consistently buy at the bottom or sell at the top. This can rarely be consistently done.

• When trading, remain objective. Don’t have a preconceived idea or prejudice. Said another way, “the great names in Trading all have the same trait: An ability to shift on a dime when the shifting time comes.”

• Any dead fish can go with the flow. Yet, it takes a strong fish to swim against the flow. In other words, what seems “hard” at the time is usually, over time, right.

• Even the best looking chart can fall apart for no apparent reason. Thus, never fall in love with a position but instead remain vigilant in managing risk and expectations. Use volume as a confirming guidepost.

• When trading, if a stock doesn’t perform as expected within a short time period, either close it out or tighten your stop-loss point.

• As long as a stock is acting right and the market is “in-gear,” don’t be in a hurry to take a profit on the whole positions. Scale out instead.

• Never let a profitable trade turn into a loss, and never let an initial trading position turn into a long-term one because it is at a loss.

• Don’t buy a stock simply because it has had a big decline from its high and is now a “better value;” wait for the market to recognize “value” first.

• Don’t average trading losses, meaning don’t put “good” money after “bad.” Adding to a losing position will lead to ruin. Ask the Nobel Laureates of Long-Term Capital Management.

• Human emotion is a big enemy of the average investor and trader. Be patient and unemotional. There are periods where traders don’t need to trade.

• Wishful thinking can be detrimental to your financial wealth.

• Don’t make investment or trading decisions based on tips. Tips are something you leave for good service.

• Where there is smoke, there is fire, or there is never just one cockroach: In other words, bad news is usually not a one-time event, more usually follows.

• Realize that a loss in the stock market is part of the investment process. The key is not letting it turn into a big one as this could devastate a portfolio.

• Said another way, “It’s not the ones that you sell that keep going up that matter. It’s the one that you don’t sell that keeps going down that does.”

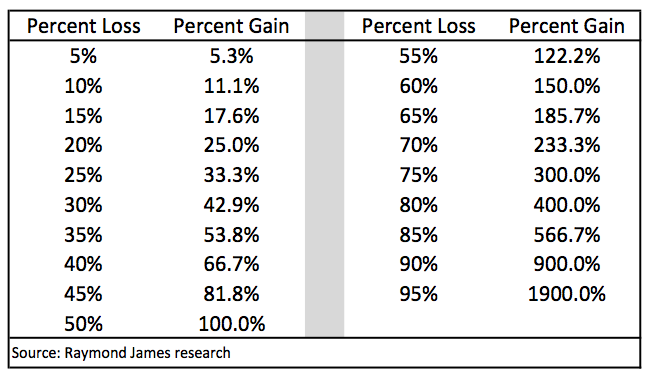

The table below depicts the percentage gain necessary to get back even, after a certain percentage loss.

• Your odds of success improve when you buy stocks when the technical pattern confirms the fundamental opinion.

• As many participants have come to realize from 1999 to 2010, during which the S&P 500 has made no upside progress, you can lose money even in the “best companies” if your timing is wrong. Yet, if the technical pattern dictates, you can make money on a short-term basis even in stocks that have a “mixed” fundamental opinion.

• To the best of your ability, try to keep your priorities in line. Don’t let the “greed factor” that Wall Street can generate outweigh other just as important areas of your life. Balance the physical, mental, spiritual, relational, and financial needs of life.

• Technical analysis is a windsock, not a crystal ball. It is a skill that improves with experience and study. Always be a student, there is always someone smarter than you!

Great stuff, Art!

>

Previously:

Bob Farrell’s 10 Rules for Investing (August 2008)

What's been said:

Discussions found on the web: