I find I enjoy analyzing equity markets more than any other. But as I have always said, you must always be objective when reviewing the data.

And what does that data show?

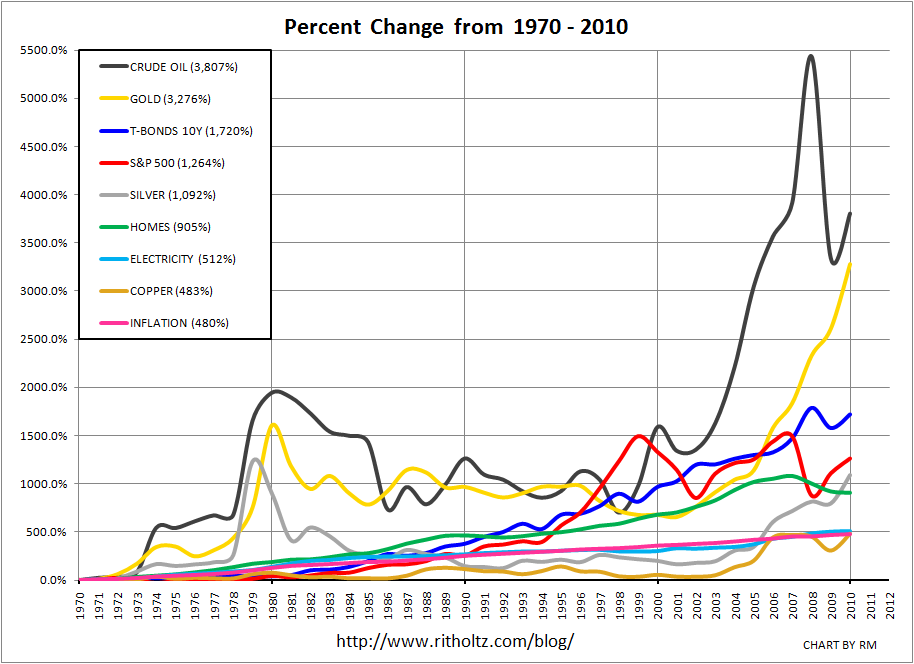

Stocks have not been the best performing asset class over the past 40 years. Outperformed not just by Oil and Gold, but Bonds as well.

What's been said:

Discussions found on the web: