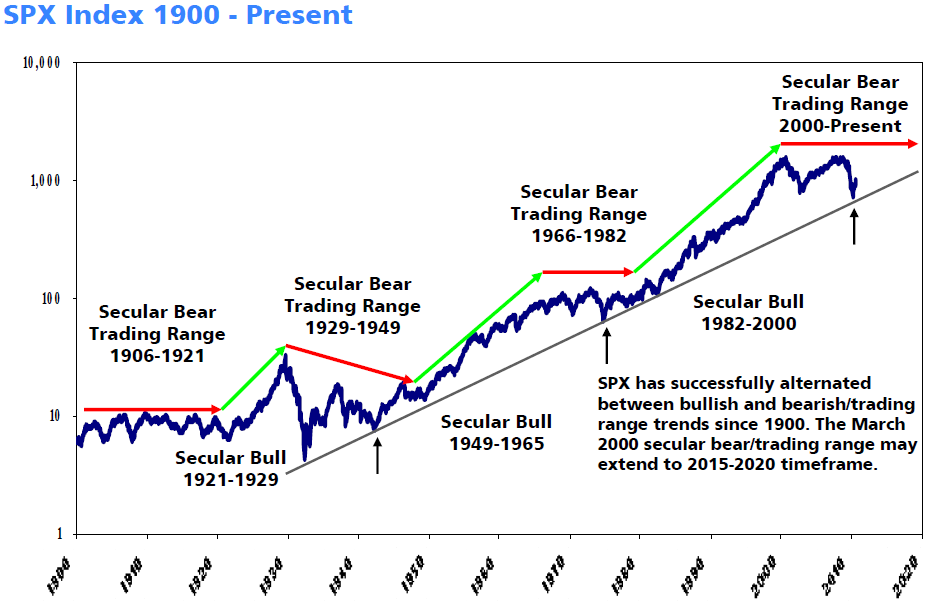

We’ve taken many longer term looks at the markets (See, for example, this, this, this or this) but the following chart from UBS Technical Analyst Peter Lee really tickled my fancy:

>

>

Source:

2011 Technical Market Outlook

Peter Lee – Chief Technical Strategist

Wealth Management Research

December 2010

What's been said:

Discussions found on the web: