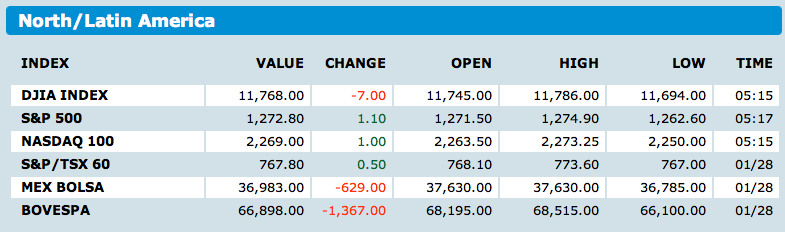

As the markets slid south 1-3% on Friday, I got a phone call from a journalist looking for a quote about Egypt: “What does this mean to the markets?”

My honest answer was “I have no idea.” While Egypt isn’t an oil nation, maybe there is a contagion effect of regional destabilization. I have no expertise in Middle Eastern politics; figuring out what the likely cascade of effects might be is far beyond my abilities.

So too the markets. They seem to have shrugged off the video images of protesting crowds clashing with police.

>

What's been said:

Discussions found on the web: