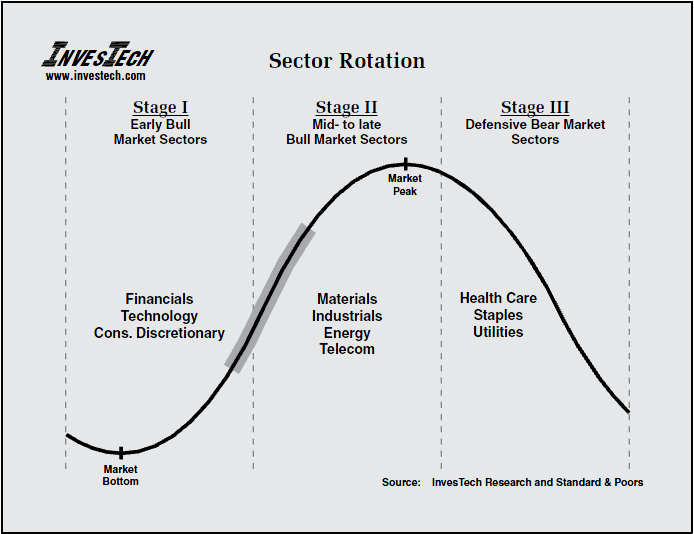

Here is another one of our favorite charts, courtesy of Jim Stack and Investech Research. It shows how leadership shifts over three stages of a Bull run:>

Stages of Sector Rotation

• Stage I: The transition from bear market to bull. Cyclical sectors — Financials, Technology and Consumer Discretionary — outperform.

• Stage II: Mid-to-late bull market. Materials and Industrials outperform, as do Energy and Telecom stocks;

• Stage III: Nondiscretionary sectors — Health Care, Consumer Staples and Utilities — Recession proof products and services — are the most resilient as the bull begins to die.

>

Three Stages of Sector Rotation

Chart courtesy of Investech Research

What's been said:

Discussions found on the web: