You may have missed Matt Phillips massive read Friday afternoon on the GSEs in the WSJ blog Marketbeat.

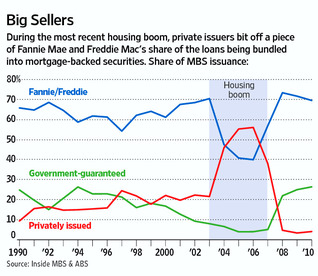

The entire piece is definitely worth your time, but I found one chart especially compelling: It shows Fannie & Freddie’s market share plummeting from over 70% to under 40%, as Wall Street securitized all manner of non-conforming mortgages:

>

>

There is no way to reconcile this chart with the jihadist blatherings of folks like AEI and CATO.

The facts of the matter are simply this: During the housing boom, it was Wall Street, and their mad purchases of Sub-Prime, Alt A and non conforming loans for their privately issued securitization that drove the credit bubble. Not, as the ideologically blinded Peter Wallison claims, Fannie & Freddie.

Class dismissed.

>

Source:

Fannie and Freddie: The Saga in Charts

Matt Phillips

Marketbeat, February 11, 2011

http://blogs.wsj.com/marketbeat/2011/02/11/fannie-and-freddie-the-saga-in-charts/

What's been said:

Discussions found on the web: