>

Short answer: Not very well.

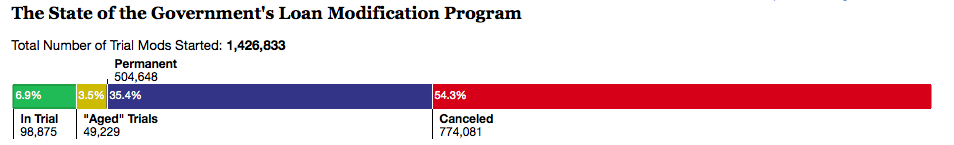

According to numbers crunched by ProPublica, more than half of the 1,426,833

mortgage mods — 54.3% — have failed.

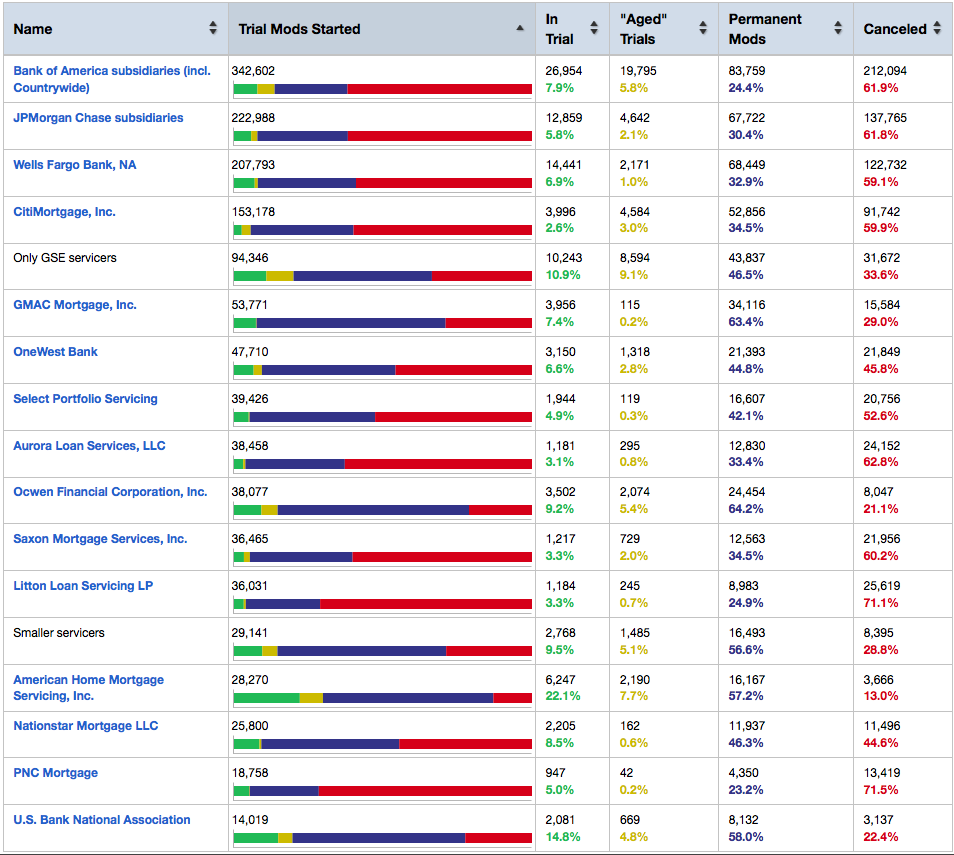

The table below shows who are the leading mortgage modders are — and its exactly who you would expect. The four largest banks dominate — Bank of America (212,094), JPMorgan Chase, (137,765) Wells Fargo (122,732) and Citi (91,742) — followed by everyone else.

The 4 biggest big banks — despite their economies of scale and allegegded expertise – have a much higher failure rate than the entire group overall. They range from 59-62%, versus 54% for the average — a full 10% worse than the median.

>

Explanation to table:

This Treasury Department data, reflecting activity through November 30, 2010, shows how the largest mortgage servicers participating in the administration’s $75 billion foreclosure prevention program have been performing.

The program features a 3-month trial period for modifications before they’re eligible to become permanent. However, many trials have gone much longer. The “Aged” column shows how many trials have gone longer than six months at each servicer, while the “In Trial” shows trials that have not yet lasted that long.

The “Canceled” column shows how many trials and permanent modifications the servicer has canceled. Here’s how that number breaks down: 729,109 trials have been canceled, 44,972 homeowners have defaulted on the permanent modification, and 590 more have paid off the loan after getting a modification.

>

See also:

Loan Mod Program Left Homeowner’s Fate in Hands of Dysfunctional Industry

Olga Pierce and Paul Kiel

ProPublica, Feb. 17, 2011

http://www.propublica.org/article/loan-mod-program-left-homeowners-fate-in-hands-of-dysfunctional-industry

What's been said:

Discussions found on the web: