>

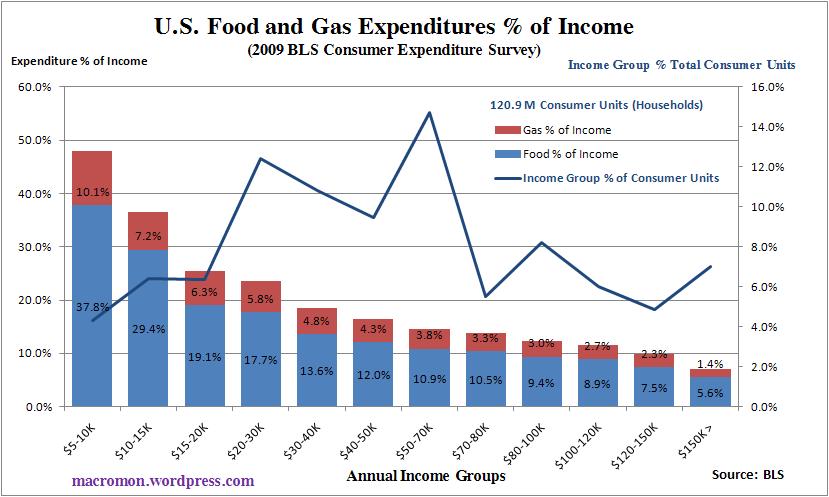

Take a look at the chart above constructed from the Bureau of Labor and Statistics 2009 Consumer Expenditure Survey. It conveys a sense of how Egypt’s poverty combined with the sharp rise in food prices sparked the political revolt against the Mubarek government.

The chart illustrates how the lower income groups in the U.S. really get squeezed when food and gas prices rise. In the U.S. the average annual income for the consumer units (households) measured is $62,857, where food expenditures consume a little over 10 percent of income.

But averages distort the true picture of what is really going on as only 15 percent of consumer units fit into this income group. Many have drowned in pools of water where the average depth is only 11 inches deep. Almost one third of the households in the U.S. spend close to or more than 20 percent of their annual income on food.

Remember this the next time the market cheerleaders and policymakers tout core CPI and dismiss food and energy inflation. It may also help explain the rise in social angst in U.S. society.

What's been said:

Discussions found on the web: