“They had to know. But the attitude was sort of, ‘If you’re doing something wrong, we don’t want to know.’ ”

-Bernie Madoff from Prison

>

The first interview for publication since being arrested in December 2008, Bernie Madoff speaks with the NYT. It is a bizarre and fascinating.

One would expect a longer interview with full Q&A to be forthcoming . . .

>

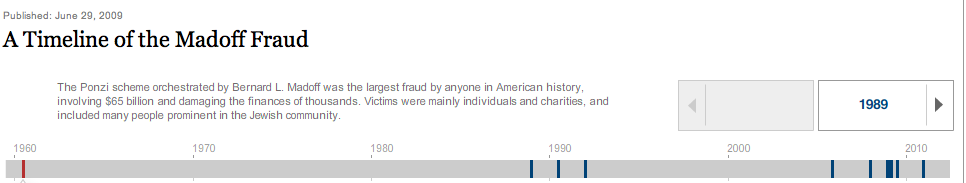

click for interactive timeline

>

Source:

From Prison, Madoff Says Banks ‘Had to Know’ of Fraud

DIANA B. HENRIQUES

NYT, February 15, 2011

http://www.nytimes.com/2011/02/16/business/madoff-prison-interview.html

What's been said:

Discussions found on the web: