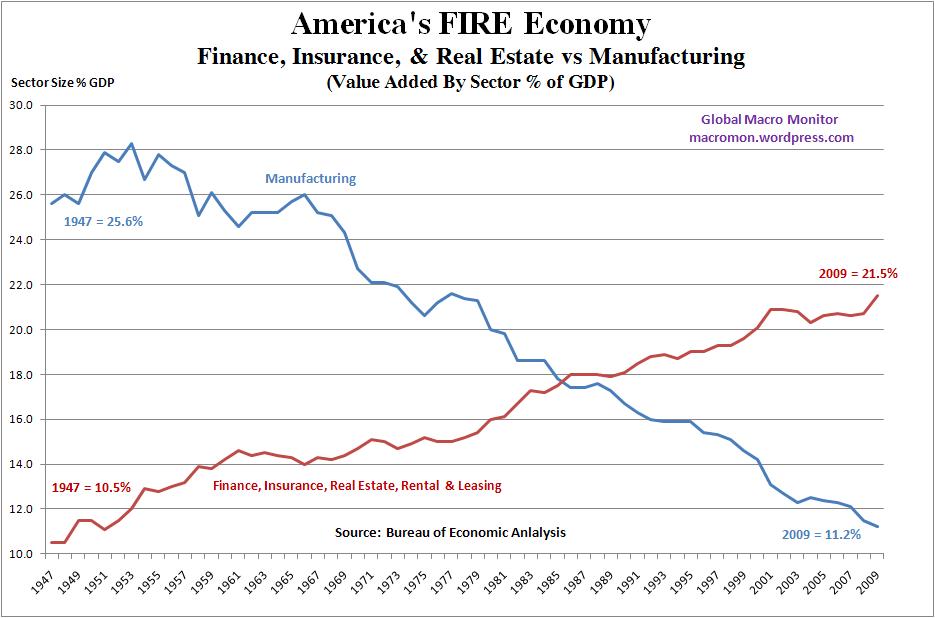

America’s FIRE Economy: The secular decline in manufacturing and the rise of finance, insurance, and real estate (FIRE) is shown relative to U.S. GDP:

>

Source: Macroman

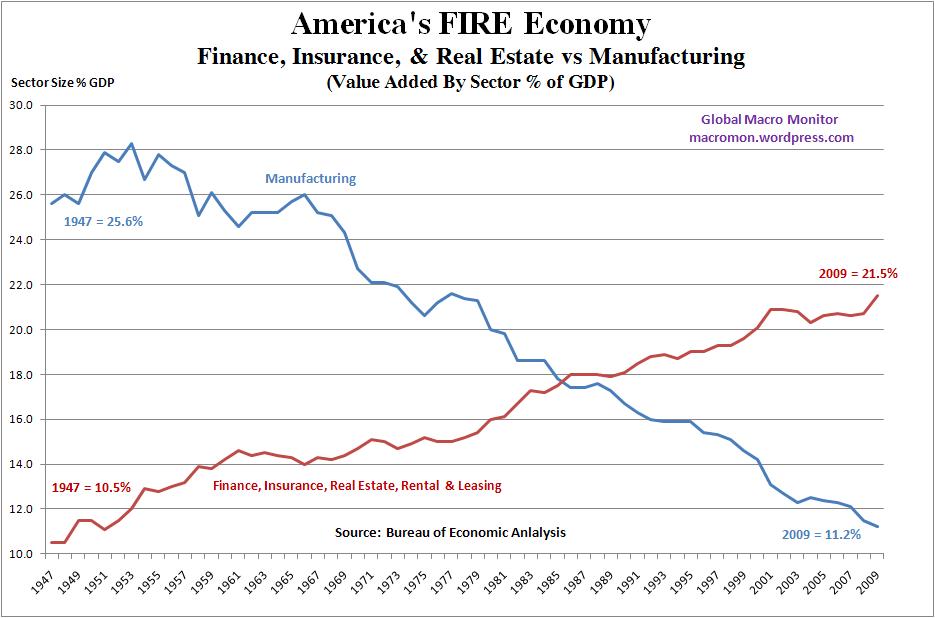

America’s FIRE Economy: The secular decline in manufacturing and the rise of finance, insurance, and real estate (FIRE) is shown relative to U.S. GDP:

>

Source: Macroman

Get subscriber-only insights and news delivered by Barry every two weeks.

What's been said:

Discussions found on the web: