Last week, we discussed data that suggested the NAR has been dramatically overstating home sales and understating stating inventory. I have a much longer piece in the works, tracing how the NAR’s data errors were discovered and by whom — but today’s must read MSM article is in the WSJ:

The National Association of Realtors, which produces a widely watched monthly estimate of sales of previously owned homes, is examining the possibility that it over-counted U.S. home sales dating back as far as 2007.

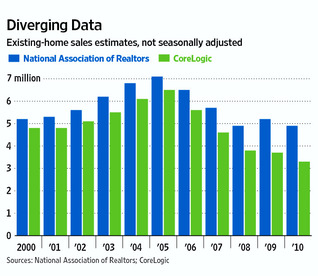

The group reported that there were 4.9 million sales of previously owned homes in 2010, down 5.7% from 5.2 million in 2009. But CoreLogic, a real-estate analytics firm based in Santa Ana, Calif., counted just 3.3 million homes sales last year, a drop of 10.8% from 3.7 million in 2009. CoreLogic says NAR could have overstated home sales by as much as 20%.

One key correction: The NAR tracking error did not begin in 2007, as the WSJ suggests, but dates bacl to their lst benchmark in 2000.

>

Previously:

Is the NAR Overstating RE Sales ? (February 17th, 2011)

Source:

Home Sales Data Doubted

Realtor Group May Have Overstated Number of Existing Houses Sold Since 2007

WSJ, FEBRUARY 22, 2011

http://online.wsj.com/article/SB10001424052748704476604576158452087956150.html

What's been said:

Discussions found on the web: