The Finance sector is back to record revenue, and of course, record bonuses and pay. I was surprised to see how much greater the Commercial Bank revenue and comp was versus Wall Street totals. When you think about it, they have many more assets, transactions and commercial activity than Wall Street does, so it makes sense.

One of the things I think people misunderstand about Wall Street pay: In finance, people are paid commission or fees or both (there are some salaried employees as well, but they are not the big bonuses getters). If you are a sales trader, for instance, you are paid based on the total volume of activity. If you did well for your clients, you may catch a bonus from them, which shows up as extra commission, year end. Some folks who are fee based are paid based on Assets Under Management (AUM), while others receive performance pay (or both).

This isn’t popular to say, but its true: There is nothing wrong with most of the compensation that is paid to Wall Street. It was the insanely misaligned compensation — getting paid huge bucks to sell things people knew were likely to blow up — that helped create the crisis. Remember, Wall Street and the Banks employ millions of people; it was much less than 1% of these people who blew the economic world up.

At AIG, the Financial Products division that brought down the firm (the intenral derivatives hedge fund that generated 32% of AIG’s profits) were less than 400 people out of a firm that once employed 116,000 people.

Its ironic that of all people, I am defending Street pay, given how vociferously I criticized Wall Street in Bailout Nation. But there is a huge between merit pay for work done and misaligned compensation.

And given that these firms were not allowed to die when they became insolvent, the outsized proportion of revenue they garner is still in effect. But for the bailouts, the definacialization of America would have proceeded. It was halted by trillions of taxpayer and Federal Reserve largesse.

Here is the WSJ:

“When it comes to paychecks, Wall Street’s law of gravity is back in full force: What goes down must come back up.

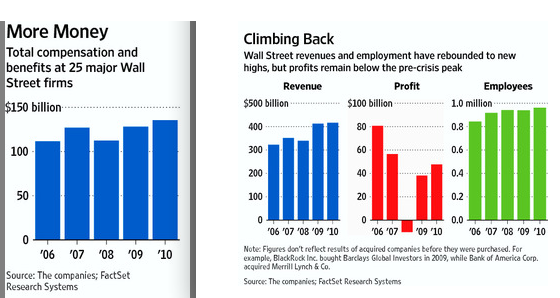

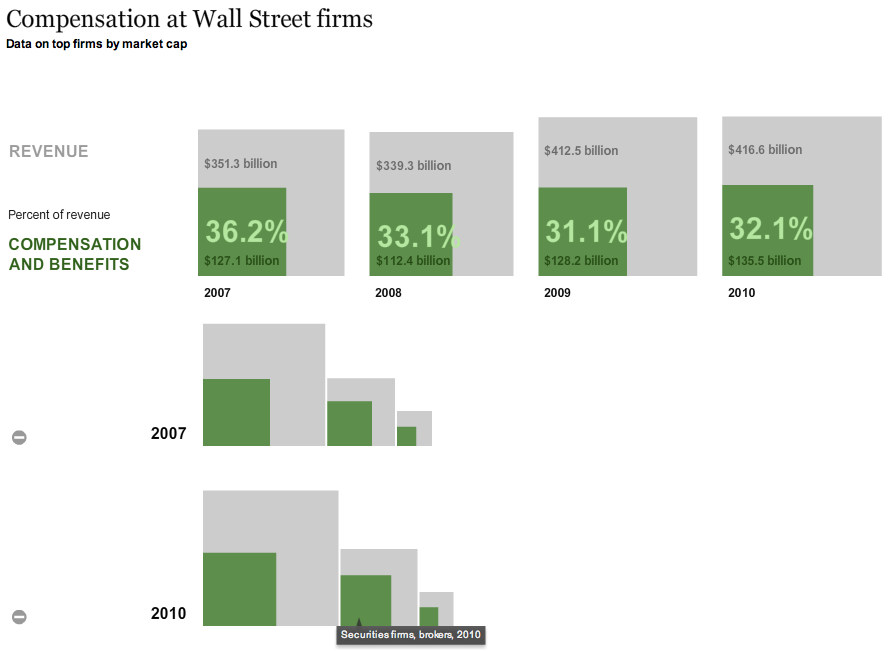

In 2010, total compensation and benefits at publicly traded Wall Street banks and securities firms hit a record of $135 billion, according to an analysis by The Wall Street Journal. The total is up 5.7% from $128 billion in combined compensation and benefits by the same companies in 2009.

The increase was fueled by a revenue rebound as the financial crisis recedes in the rearview mirror. At 25 large financial firms that have reported full-year results, revenue rose to $417 billion, another all-time high, even though last year’s 1% increase was just a fraction of the industry’s revenue jolt from 2008 to 2009 as trading and investment banking sprang back to life.”

There are some additional elements at work:

-deferred compensation made up as much as half of total pay, up from about a third peviously

-increased base salaries, rather than Smash & Grab bonuses. (to “encourage employees to focus on longer-term”)

-Employees who boosted the bottom line got much of the gains in pay — the “star system” is very much in effect.

>

>

>

Source:

On Street, Pay Vaults to Record Altitude

AARON LUCCHETTI And STEPHEN GROCER

WSJ, FEBRUARY 2, 2011

http://online.wsj.com/article/SB10001424052748704124504576118421859347048.html

What's been said:

Discussions found on the web: