“The rates are great but the underwriting is brutal. They hang these people upside down and shake them till they see what falls out of their pockets. So people are buying with cash and maybe they’ll ‘refi’ later.”

-Henry Schlangen, Pacific Union International real-estate agent in Napa Valley, Calif.

>

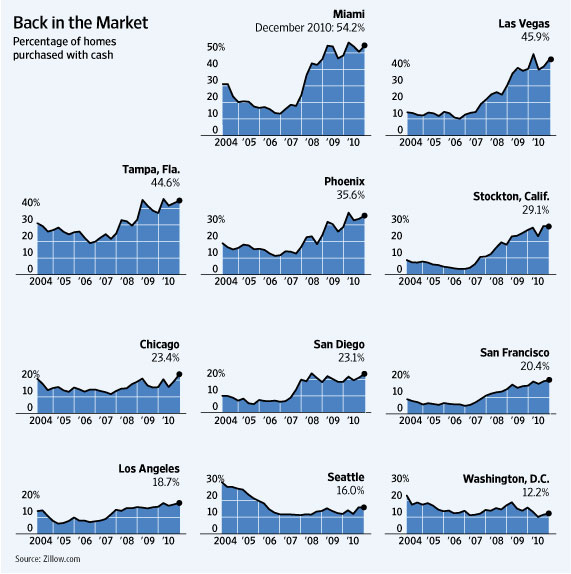

The agent quote above estimated that “95% of his deals last year were all-cash, up from about half in previous years.” And in South Florida (perhaps not the ideal example) Cash buyers represented more than half of all transactions in the Miami-Fort Lauderdale in 2010 (data via Zillow.com). In Q4 2006, they were just 13% of deals.

Is the jump in cash purchases of mostly distressed real-estate “another sign of the revival of animal spirits in the U.S. economy” ?

That is what the author of the WSJ article Cash Buyers Lift Housing suggests this morning.

Only, not exactly. I reach a different conclusion based on why cash is being used. The use of all cash signals not the revival of animal spirits, but excessive caution on the part of lenders, and other structural difficulties in the residential market.

There are many reasons, and not all of them are positive, to use all cash:

-5% to 10% discount for cash

-A surge of Buyers from China

-Difficulty appraising homes in a foreclosure heavy areas

-Return of speculation to the condo market

-Challenging environment for credit, especially jumbo mortgages.

-Bargain hunting renters with ready cash

Certain areas more than others are showing increased cash deals. The correlation between the extent of the drop from previous peak prices and foreclosures is fairly significant. The Journal notes that “the harder a market has been hit, say economists, the higher the percentage of cash deals.”

And credit remains difficult: “Some of the cash purchases reflect a tight lending environment, where even people with good credit and ample down payments are sometimes turned away for conventional borrowing.”

Meanwhile, downtown Miami prices rose 15% in 2010 from a year earlier, according to the Miami Downtown Development Authority.

>

>

Source:

Cash Buyers Lift Housing

S. MITRA KALITA

WSJ, FEBRUARY 8, 2011

http://online.wsj.com/article/SB10001424052748704570104576124502975117950.html

What's been said:

Discussions found on the web: