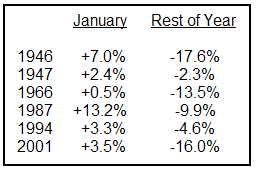

What we call the All-January Barometer* has had six false positives since 1940, where January was up, but the rest of the year was down. If dividends are considered, then there were five false positives since from February through

December of 1947 the U.S. stock market experienced a positive total return.

Last year, 2010, was by far the biggest of the 14 false negatives since 1940, where January was down, but the rest of the year was up. Thus January has failed to signal the direction for the rest of the year 19 to 20 out of the past 71 years, or about 27-8% of the time.*

And being correct 72-3% of the time** is statistically the same as betting that the stock market will be up every year, which it has been 52 out of the 71 years since 1940, or 73% of the time.

*. There are two other well-known January Barometers, which we call the “Jan5-Rest of Jan” and the “Jan5-Rest of Year,” each which use the stock market performance during of first five trading days to project the rest of January and the rest of the calendar year, respectively. They have even lower Bayesian probability than the “All-January Barometer”, or equivalently the “Jan-Rest of Year Barometer” presented here.

** The historical trend has been getting worse since 12, or 60-63% of the 19 to 20 failures, have occurred during the 32 years since 1978, or the most recent 45% of the 71 years, which is a 37% higher failure rate.

*** This is using Bayesian probability analysis with the S&P 500 index (on a price only basis, or without dividends) since 1951, and the DJIA 30 before 1951. Regression analysis is usually much more useful since it also takes Magnitude into account, rather than just the positive or negative direction of the stock market’s performance. However, careful analysis of the scattergram chart below shows that the trivial r-squared of 7% is due to small January performances, since the ten largest ones actually have a negatively-sloped regression line that has almost twice the r-squared of 13.5%.

>

click for ginormous graph

What's been said:

Discussions found on the web: