Philippa Dunne & Doug Henwood are the minds behind The Liscio Report on The Economy. Their real time, proprietary research based on state witholding and sales tax receipts is used by professional traders’ to obtain a unique insight into the state of the employment situation and the US economy. See the Liscio Report site for more info on their subscription services.

This is their first guest post for The Big Picture:

~~~

Mismatching the facts

We are hopeful that a recent report from researchers at the San Francisco Federal Reserve on the job prospects of recent graduates will finally bury the assertion that the unemployment rate is persistently high because workers lack the skills for the jobs that are available, or live in the wrong region. As our subscribers know, we have never been fans of Minneapolis Fed President Narayana Kocherlakota’s skills mismatch theory of unemployment. Serious flaws in his argument were evident when he first presented it back in August, and yet a surprisingly large number of market participants lionized his conclusions.

The biggest problem is that a longer look at a central component of his argument, the relationship between job openings and the unemployment rate, does not support his conclusion. Although Kocherlakota was correct that in July 2009 the Beveridge Curve, a gauge of how efficiently the job market is functioning, suggested that the unemployment rate should be lower than the BLS was reporting, up until then it had indicated no problem in the relationship between its two components, job openings from the JOLTs series, and the unemployment rate. It’s worth noting that earlier in the year, the number of unemployed had fallen by about a quarter-million more than job openings had increased, but the important point is that surely if there were a mismatch between skills and jobs, or regions and workers, it would have been apparent long before the repercussions of the financial meltdown took down the labor market. Scientist Richard Dawkins has noted that gullibility is delightful in a child but horrifying in an adult, and it was dispiriting that so few analysts pointed out the suspicious and sudden timing of the supposed mismatch of our workers and available jobs.

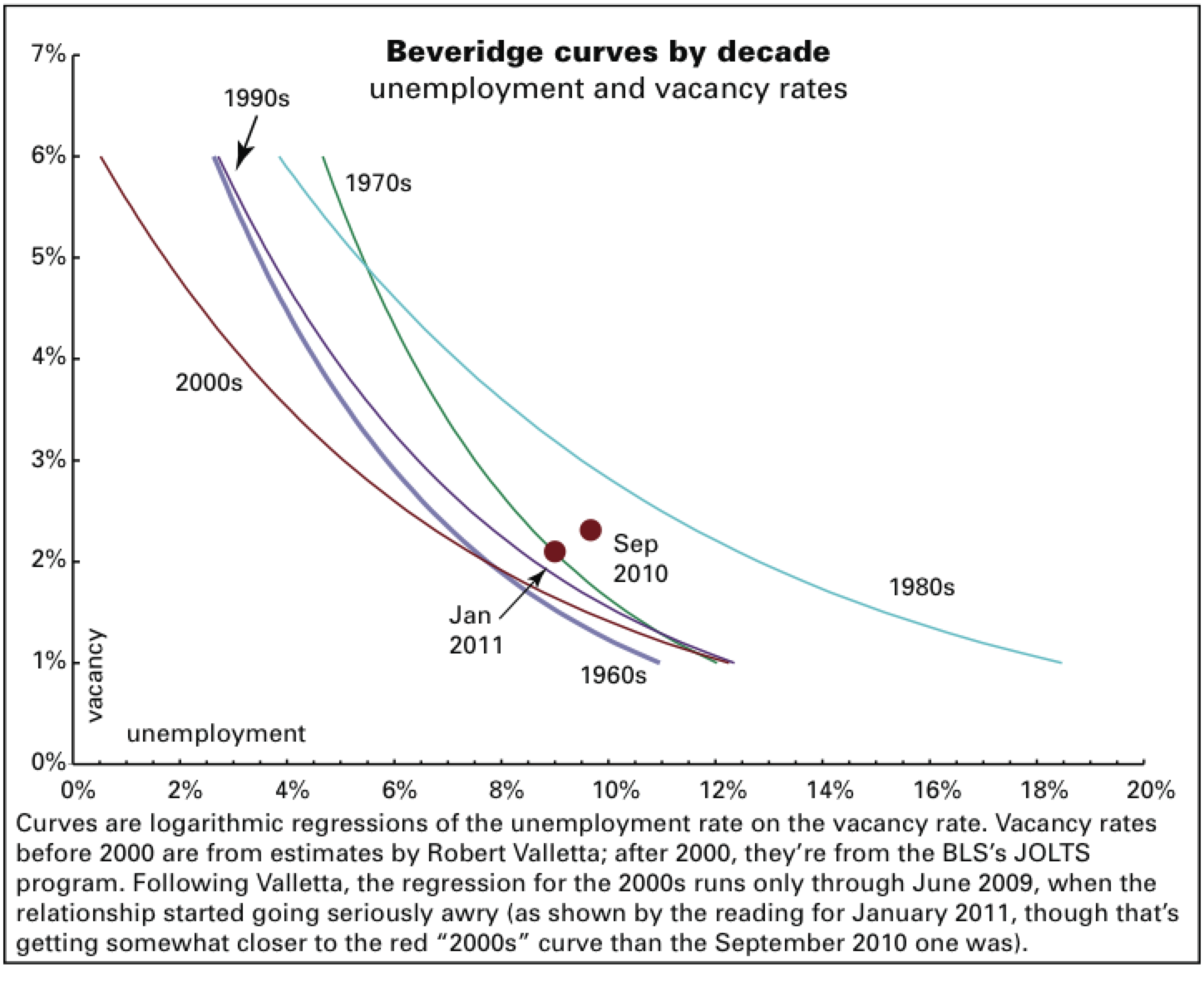

By limiting his study to the job openings data from the Job Openings and Labor Turnover (JOLTs) series that begins only in 2000, Kocherlakota missed the important fact that the Beveridge Curve has a history of swinging wide before falling back into its more normal pattern. The graph below shows the curve by decade, an idea taken from a SF Fed Economic Letter by Rob Valletta and Katherine Kuang, employing the Conference Board’s Help Wanted index as a proxy for JOLTs data in the decades prior to 2000. (Using the period of overlap between JOLTS and HW, Valletta estimated a consistent vacancy rate series going back to 1960 that he kindly shared with us.)

The labor market is usually thought to be functioning more efficiently the further down and to the left (i.e. closer to the origin) the curve is on the graph. The further out it is, the more friction, like regional and sectoral mismatches. The curve for the 2000s (which is based on data through June 2009, when the relationship prevailing earlier in the year started to break down) shows a much better functioning labor market than in earlier decades, especially the 1980s.

Until, that is, we get to recent history, as shown by the red dot marking September 2010. But as Valletta and Kuang point out, the curve shifted about 4 points to the right between the 1960s and the early 1980s before moving leftward by about 2.5 points between 1984 and 1989, a period when the variations in the NAIRU (Non-accelerating Inflation Rate of Unemployment) were considerably smaller than the movement of the curve would suggest. (Note recent improvement in this metric.)

But there is no shortage of evidence that we are moving through a period of severe and sticky cyclical unemployment. First, of course, the recession was unusually severe, and the major reason employment took such a hit was the hit to GDP. As the graphs directly below show, the loss in output was greater than any earlier recession, but the difference between the change in GDP and the change in employment wasn’t out of line with earlier experience.

Another thing that is really different about this cycle is the share of permanent job losers, as opposed to those on temporary lay-off. The percentage of the employed who have lost their jobs permanently hit a record high, in 40 years of data, at the end of 2009, and has come down only slightly since, while the percentage of those on temporary layoffs hit a record low in 2009 and has yet to recover. This composition makes re-employment a lot harder, as does the large number of workers employed part-time for economic reasons. Currently those working part-time against their will constitute 5.9% of the total employed, barely down from July’s 6%, which was well over 2 standard deviations above the series’ 55-year average. They will probably find full-time work before the currently unemployed find any work. Many of the current long-term unemployed may never work again.

Piling on

In The Labor Market and the Great Recession, a paper prepared for a Brookings Institute panel last spring, Michael Elsby, Bart Hobijn, and Aysegul Sahin review the grim pathologies of our labor market, and point out that in almost every aspect, the downturn was the worst since the 1930s. Concerning Kocherlakota’s argument they note that instead of a divergence in outflows from unemployment between industries in structural decline and those not in decline, the rates of sectoral outflow have converged. (Outflow rates in the financial, durable goods and information sectors were all lagging the total when Elsby et al. published.) They also found that while inflows into unemployment in the early part of the recession were dominated by the weaker demographics—the young, the less educated, the nonwhite—the rate of exit has been broadly similar for all subgroups. So both for sectors and demographics, the problem is largely an aggregate one.

Elsby et al. also argue against Kocherlakota’s (and others’) point that the extension of unemployment insurance benefits is major cause of the high unemployment rate. They calculated that the extension of benefits likely added between 0.7 and 1.8 points to the 5.5 point rise in unemployment, and probably at the low end of the range, which is well below estimates circulating in response to Kocherlakota’s speech, and noted that the JOLTs quit rate was (and is) remarkably low, which suggests that employed workers, who presumably have the qualifications employers desire, are skeptical about the possibility of finding new jobs.

In their SF Fed Economic Letter mentioned above, Kuang and Valletta also took a look at the regional and sectoral behavior of employment, and found little evidence for the mismatch thesis. If there were a serious mismatch problem, you’d expect to find major disparities in employment across geography and industry: healthy regions or sectors would show shortages of workers, and sickly ones would show surpluses. But in fact Kuang and Valletta didn’t see that: current regional and sectoral variation is little different from past cycles.

In early March, newly minted SF Fed President John Williams noted that the NAIRU has probably risen from 5% to 6.7%, with half of the increase coming from extended unemployment benefits (which will wane soon enough), and the rest from the severe shocks the labor market, and especially the construction sector, has experienced. He notes that the NAIRU will likely fall back over the next few years on its own.

In Mid-March SF Fed researchers Bart Hobijn, Colin Gardner, and Theodore Wiles took a look at unemployment rates for two groups, those 21 to 23 years old with a college degree (the cohort sample), and those 21 to 25 years old who have a college degree but did not have one 12 month before (the matched sample). They selected these groups because recent graduates are subject to none of the constraints that go into the mismatch theory: they are seldom eligible for unemployment insurance benefits; they are well educated; and they are usually mobile. But the unemployment rates for both groups are higher than the overall rate: the cohort’s rate bottomed at about 5.8% early in the recession, has risen steadily since, and is now 10.7%; the matched sample’s was 7.9% at the beginning of the recession and is now 15.7%. If the mismatch theory were true, this would not be the case.

Stepping back

To put this all into the correct perspective, the US labor market is tracking the average trajectory of labor markets following major financial crises closely. In the 15 major financial crises in 13 rich industrialized countries identified and studied by the IMF, labor markets did not regain their pre-crash momentum for about 5 years. As those who familiarized themselves with the aftermath of financial crises early on understood, our labor market was going to suffer extensive long-term damage. To give you an idea of how severe that damage has been, in the last few years dramatic job losses have caused the long-term relationships of various components of the Bureau of Labor Statistics’ models to break down. For example, the balance between business births and business deaths that is the basis of the birth/death model, and has been remarkably stable in past business cycles, currently does not hold, which is why we have had two years of unusually large downward benchmark revisions. Although the job market is showing signs of improvement, a painfully slow recovery with persistently high unemployment is what we should have expected, and it’s what we have. There is no reason to concoct explanations for any of the details.

When Kocherlakota was appointed president of the Minneapolis Fed, some of his colleagues remarked that he is data-driven and changes his views when the data insist he do so. In that case, we should be hearing something from him on this issue soon.

-Philippa Dunne & Doug Henwood

>

Sources:

The Labor Market in the Great Recession, May 2010 (May 2010)

http://www.nber.org/papers/w15979

Inside the FOMC (August 17, 2010)

http://www.minneapolisfed.org/news_events/pres/speech_display.cfm?id=4525

Is Structural Unemployment on the Rise? (November 8, 2010)

http://www.frbsf.org/publications/economics/letter/2010/el2010-34.html

Will the Financial Crisis Have a Lasting Effect on Unemployment? (February 22, 2011)

http://www.frbsf.org/economics/speeches/2011/john_williams0222.php

Recent College Graduates and the Labor Market (March 21, 2011)

http://www.frbsf.org/publications/economics/letter/2011/el2011-09.html

Bureau of Labor Statistics’ comments on 2009 benchmark (February 23, 2010)

http://www.bls.gov/ces/cesbmart09.pdf

~~~

The Liscio Report on The Economy is the professional traders’ secret weapon. Our real time proprietary research based on state witholding and sales tax receipts gives our clients a unique insight into the state of the US economy.

If you would like to talk to us about customized research or would like more information about The Liscio Report, please call Marni at 877-324-1893, or click here to email us.

To subscribe click on the subscribe link here.

What's been said:

Discussions found on the web: