Excellent news: Despite the best efforts of misguided government policies (tax credits, mortgage mods, foreclosure abatements) and the Fed (ZIRP), Home prices are falling towards normalized levels. (Yeah!)

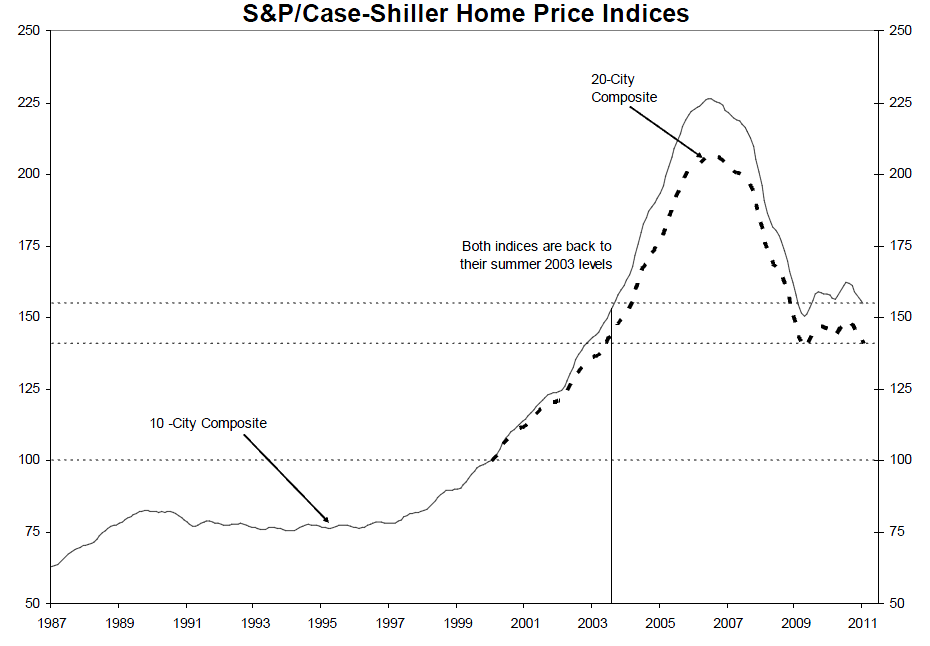

That is the result of the latest Case Shiller data for January 2011: “The 10-City Composite was down 2.0% and the 20-City Composite fell 3.1% from their January 2010 levels.”

The chart below shows that we have now reverted back to price levels where housing markets launched into their vertical 3 year price rise.

What we have yet to erase is the excess speculation from the 2002 to 07 mania. Until that gets wrung out of the market, I doubt you will see a healthy Real Estate sector. That will only take place through a combination of lower prices, better holders and the elapsing of time.

The good news is that is happening. The bad news is its a slow painful slog . . .

>

(As always, click for ginormous chart)

>

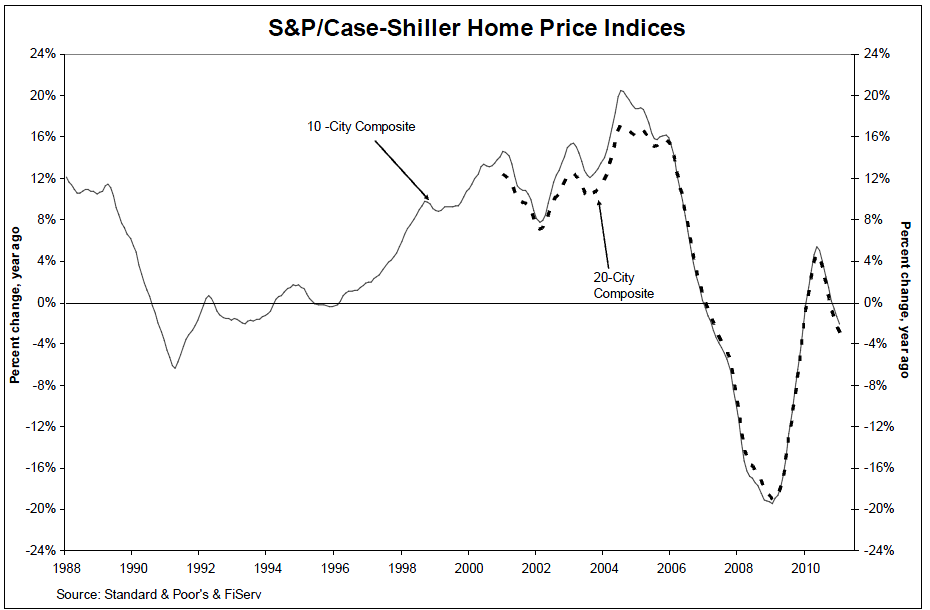

One of 20 areas (D.C.) rose last month, preventing another shutout (one of 20 rose in each of December (Cleveland) and November (San Diego); all 20 declined in October).

Here’s how far back each of the 20 areas (and the 10 and 20) have fallen:

>

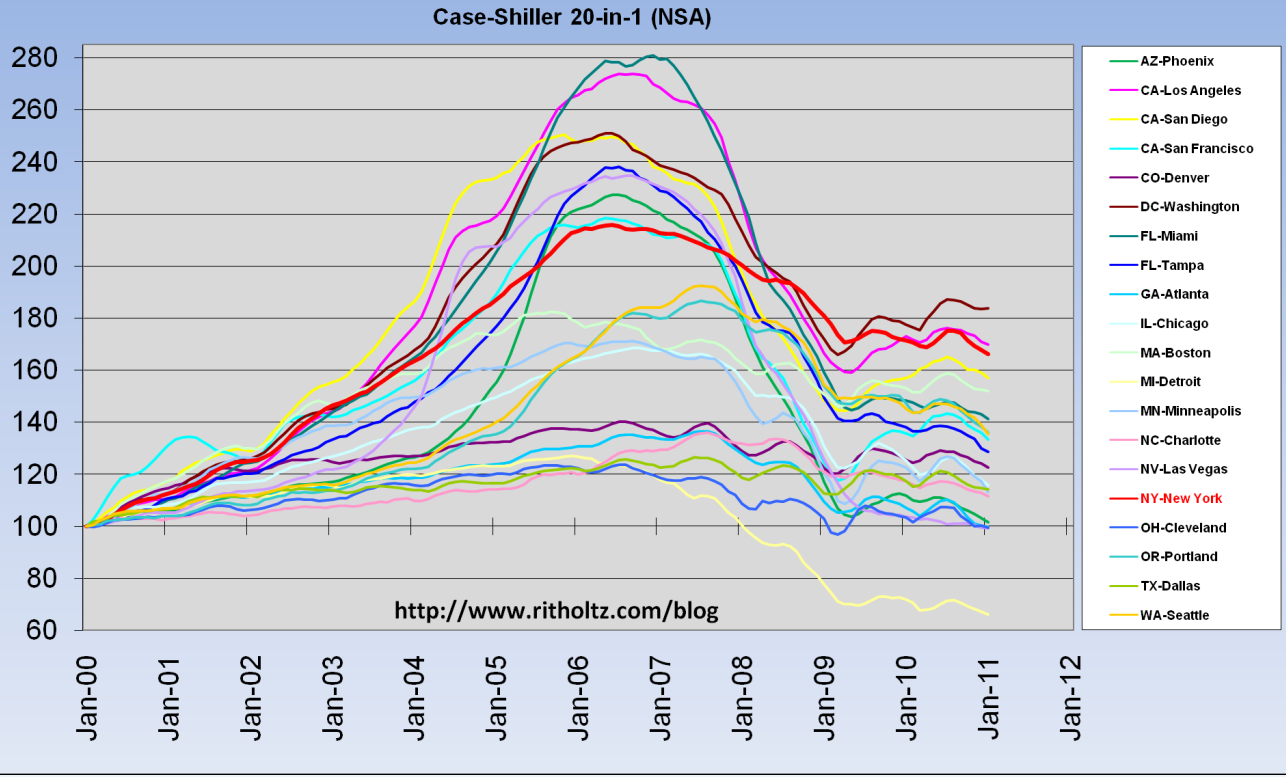

And all 20 metro regions on one chart:

>

More charts after the jump

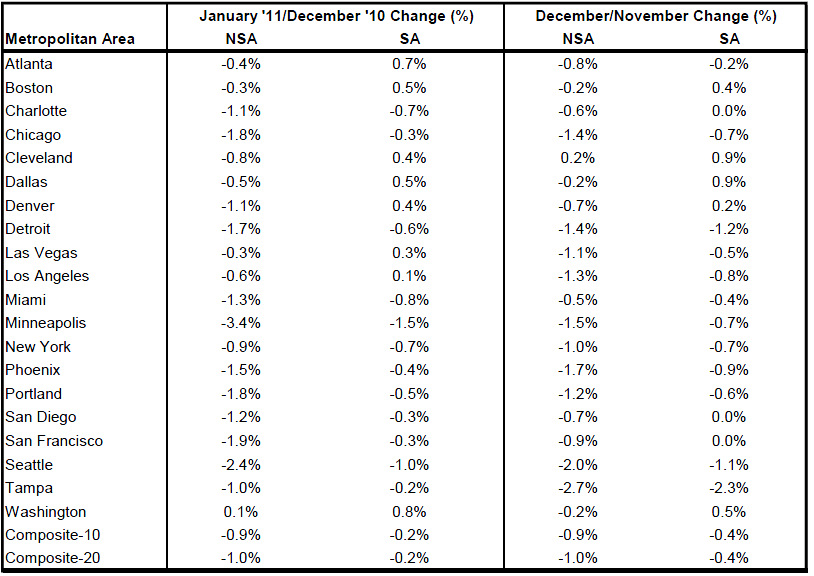

A summary of the monthly changes using the seasonally adjusted (SA) and non-seasonally adjusted (NSA) data can be found in the table below.

Source: Standard & Poor’s and Fiserv; Data through January 2011

What's been said:

Discussions found on the web: