Today’s must read article is a NYT piece about the amazing non-profit tax-paying entity known as GE.

Yet another reason why you don’t bailout companies whose inability to manage risk allowed themselves to become destroyed: They not only do not deserve to continue with the same management/shareholders/creditors who all created the insolvency in the first place, but they are ungrateful bastards as well.

>

>

Source:

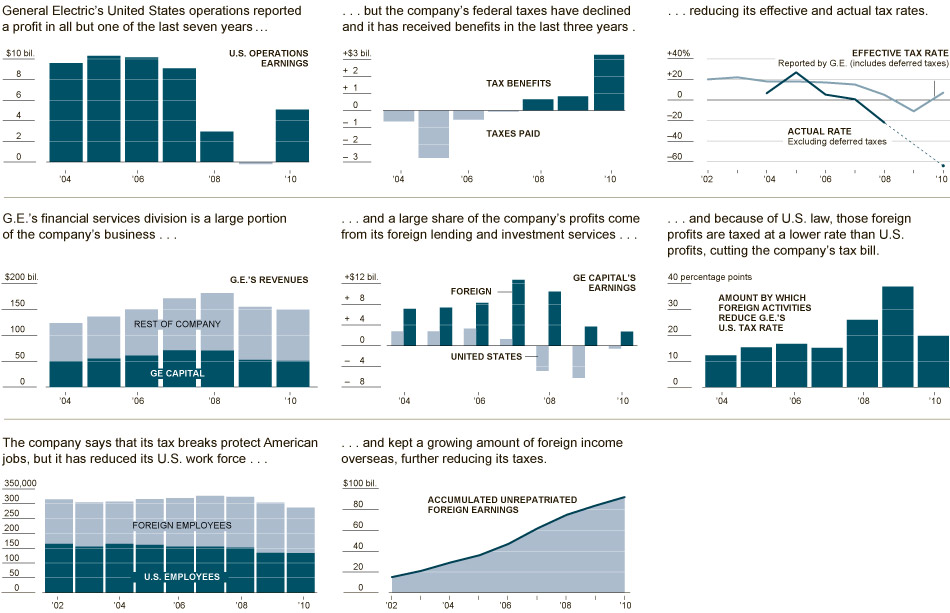

G.E.’s Strategies Let It Avoid Taxes Altogether

DAVID KOCIENIEWSKI

NYT, March 24, 2011

http://www.nytimes.com/2011/03/25/business/economy/25tax.html

What's been said:

Discussions found on the web: