>

Interesting observations from Merrill Lynch’s Sheryl King and Ryan Bohren. They believe Canadian housing is “in bubble territory” with commensurate “down-side risks remain despite an accelerating economy.”

However, they are not looking for a Canadian Housing crash.

The “structure of the Canadian mortgage market greatly reduces the probability of a US style housing melt-down.” The US had excessively risky lending by vulnerable financial institutions, along with vastly over supplied housing market.

What makes Canada so different?Four factors of the Canadian mortgage market:

1. We find government guaranteed mortgage insurance mitigates risk to financial institutions. Unlike the US where financial institutions were clearly over exposed and the solvency of insurance providers were questionable. 75% of mortgages in Canada are fully insured with Government guarantees and all mortgages with an LTV higher than 80% must be insured by regulated lenders.

2. Legal recourse laws reduce the risk of households walking away from their mortgage and implicitly improve lending quality, unlike the US where reports of abandoned vacant homes were and remain rampant. By our estimation around 90% of mortgages are full recourse in Canada, creating a more lender-friendly environment.

3. About 30% of the mortgage funding market has a federal government guarantee, which likely reduces the risk of a US style funding freeze. Indeed during the height of the credit crisis, the Government of Canada initiated a very effective Insured Mortgage Purchase Program which essentially kept the Canadian mortgage market functioning.

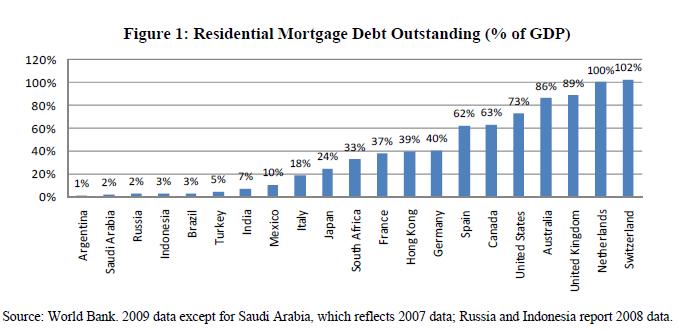

4. Canadian’s have historically held lower leverage ratios than their US counter parts and tend to gravitate to more conservative mortgage options. Canadian household balance sheets have deteriorated and have been treading into more risky areas like variable rate mortgages, but sub prime lending remains a virtually non-existent market in Canada.

>

UPDATE: March 21, 2011 3:22pm

Here is the Merrill piece:

>

Source:

Why no Canadian, Australian housing busts?

Tracy Alloway

FT Alphaville, Mar 21 15:31.

http://ftalphaville.ft.com/blog/2011/03/21/521346/why-no-canadian-australian-housing-busts/

What's been said:

Discussions found on the web: