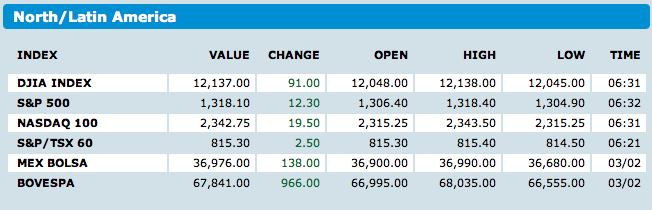

Futures are very strong today — I expect trading today will be the key pivot point of this rally. If it fails today, we should expect significant downside, on the order of 5-10%.

If the rally shows breadth, volume, and a close near the highs, it will make me rethink my correction stance.

More to come later . . .

What's been said:

Discussions found on the web: