I was working on a column for the Washington Post on the IBGYBG Wall Street bonuses, when my partner Kevin Lane (the wizard behind the FusionIQ algorithms) pointed me to this article — Compensation 2011: Your definitive guide to advisor compensation across the industry — published at On Wall Street.

Its a little “inside baseball,” about compensation structures on Wall Street. It is not about the insane bonuses for the guys who blew up the world and bankrupted their firms, but rather about the regular boys and girls working in the trenches of finance.

Most of these folks finance people wear two hats: They are both sales people who get paid based on their sales production (either commissions or fees), as well as managing the assets under their care.

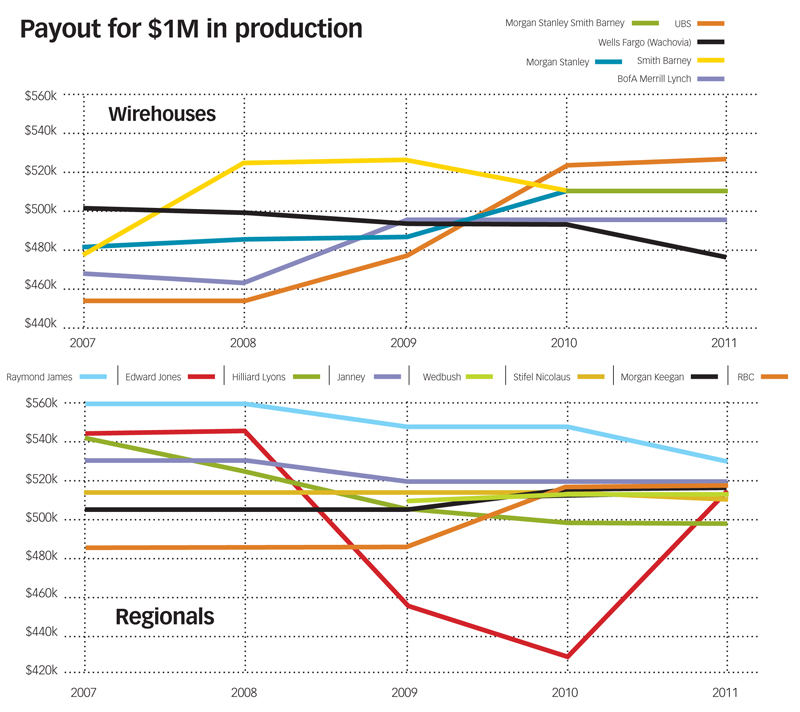

The chart that caught my eye was this comparison between wirehouse and regional compensation on a theoretical $1 million in production (Example: $75 million in assets at a 1.5% fee).

If you are curious as to what firms are paying the most to their employees, this is the chart for you:

>

>

Source:

Compensation 2011: Your definitive guide to advisor compensation across the industry

Lee Conrad and Lorie Konish

March 1, 2011

http://www.onwallstreet.com/ows_issues/2011_3/compensation-2011-the-biggest-and-the-best-comp-plans-2671610-1.html

What's been said:

Discussions found on the web: