Two seemingly contradictory articles are in the WSJ today:

Perhaps we can help reconcile them.

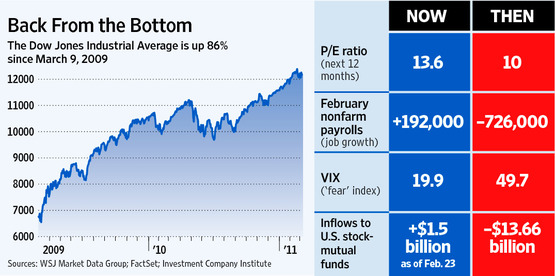

The Dow has recovered from a deeply oversold condition; some of this was the natural elapsing of time, as the panic passed and things moved back towards normal.The economy has not only backed away from the abyss, it has legitimately improved.

But a huge amount of the gains have come from the combination of the bailouts — ill thought out giveaways to incompetently and mismanaged banks — and the massive bloating of the Fed balance sheets. ZIRP, QE and the artificially steepened yield curve are what have created a boom for stocks.

At the same time, Banks have been the laggards in the rally since the August lows, and with good reason: Their true condition is well understood. We know that Bank stocks are not reporting their books accurately. FASB 157 allows them to hide bad loans. The Extend & Pretend approach is well known.

The reconciliation between these two articles is simple: People know that equities have moved higher, and the worst of the crisis is behind us. But the artificial nature of this has them nervous. Recency effect notwithstanding, they are waiting the other shoe to drop once the steroids wear off.

The charts below show the basis of concern:

>

What's been said:

Discussions found on the web: