>

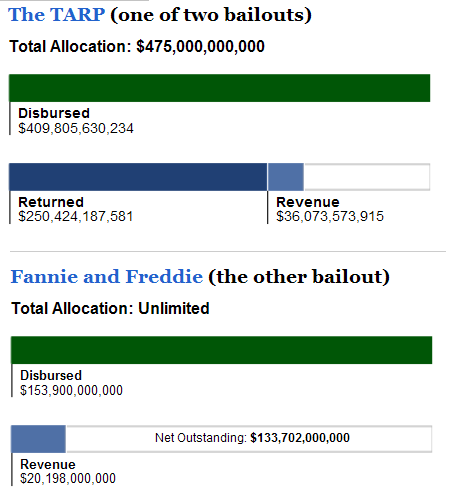

No, we are not profitable on the bailouts. TARP has $123B to go before breakeven, and the GSEs are $133B in the hole.

All told, the Taxpayers have a long way to go before we are breakeven. That’s before we count lost income from savings, bonds, etc., the increased costs of food stuff and energy due to inflation (the Fed’s has done this on purpose as part of their rescue plan), the higher fees the reduced competition of megabanks has created, and the future costs our Moral Hazard will have wrought in increased risks and disasters.

As the nearby charts show, we are far far from breakeven:

>

Sources:

Behind Administration Spin: Bailout Still $123 Billion in the Red

Paul Kiel

ProPublica, March 17, 2011, 10:27 a.m

http://www.propublica.org/article/behind-administration-spin-bailout-still-123-billion-in-the-red

The State of the Bailout

http://projects.propublica.org/bailout/main/summary

What's been said:

Discussions found on the web: