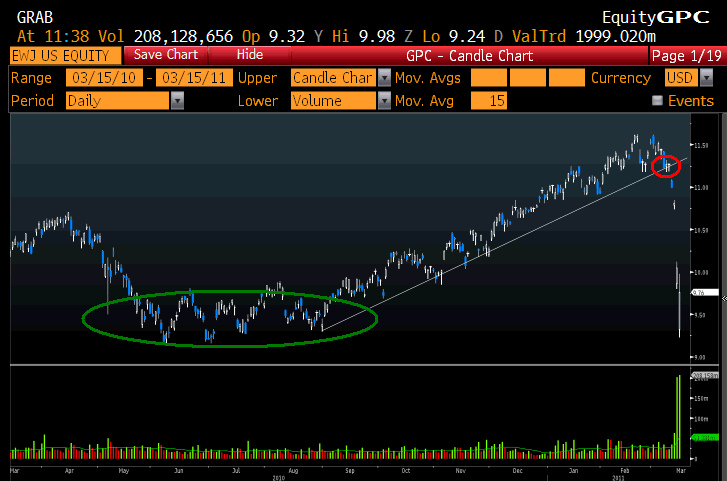

click for larger chart

Chart courtesy of FusionIQ, Bloomberg

>

I wanted to follow up a post from last year about EWJ. Back in December ’10, I mentioned 10 Reasons I Am Thinking About Japan. Regardless of your views going forward, if you owned or traded this, you should have had a plan in place, and executed your strategy on it.

I wrote than “Note how many times EWJ got turned back at $11. What would get me really excited was a high volume breakout over $10.90-11.”

EWJ did manage to get over $11, kissing $11.60 — but on rather mediocre volume. If you were thinking about a big position, the lack of volume should have kept you small (or out altogether).

Regardless, you should have followed your discipline. It could have included such rules as:

• Buy the stock on a high volume breakout over $11 (1st chart here)

• Sell the stock when the uptrend is decisively broken (Red circle)

• Buy the stock when it falls back to support at $9 -9.50 (Green circle)

You will never know when an event(s) such as an Earthquake/Tsunami/Nuclear accident will occur, but you certainly can have a trading plan in place way before hand. Having a plan, and having the discipline to execute that plan is crucial to success as an investor or trader . . . .

What's been said:

Discussions found on the web: