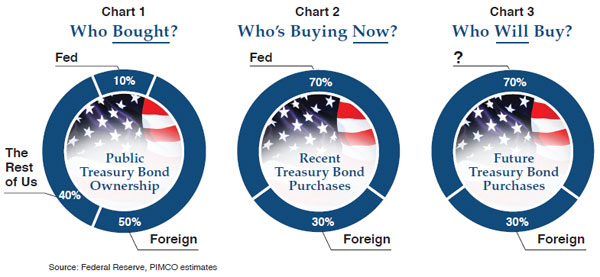

Today’s chart comes to us via PIMCO’s Bill Gross:

>

Chart via PIMCO

>

Gross describes the issue thusly:

“What an unbiased observer must admit is that most of the publically issued $9 trillion of Treasury notes and bonds are now in the hands of foreign sovereigns and the Fed (60%) while private market investors such as bond funds, insurance companies and banks are in the (40%) minority. More striking, however, is the evidence in Chart 2 which points out that nearly 70% of the annualized issuance since the beginning of QE II has been purchased by the Fed, with the balance absorbed by those old standbys – the Chinese, Japanese and other reserve surplus sovereigns. Basically, the recent game plan is as simple as the Ohio State Buckeyes’ “three yards and a cloud of dust” in the 1960s. When applied to the Treasury market it translates to this: The Treasury issues bonds and the Fed buys them. What could be simpler, and who’s to worry? This Sammy Scheme as I’ve described it in recent Outlooks is as foolproof as Ponzi and Madoff until… until… well, until it isn’t. Because like at the end of a typical chain letter, the legitimate corollary question is – Who will buy Treasuries when the Fed doesn’t?“

Gross cites June 30th, 2011 as the new “D-Day” — fraught with hope for victory.

What's been said:

Discussions found on the web: