Its been a few months, and its time to update this chart of US Debt Holders from Political Calculations.

In the Think Tank this morning, Jim Bianco looks at the related question “What Will Be Sold To Pay For Japanese Reconstruction?”

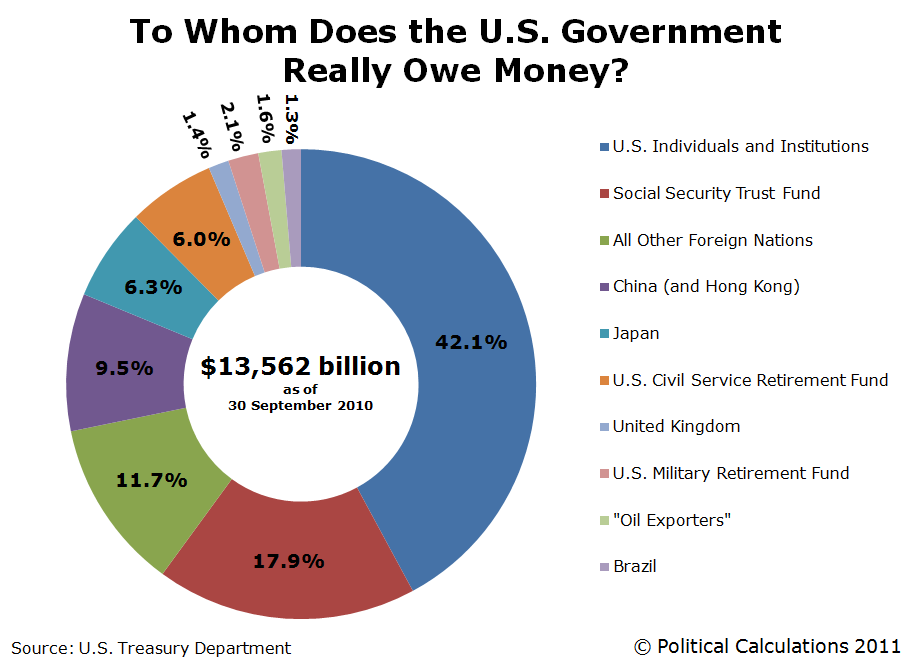

Here’s Political Calculation’s chart:

>

>

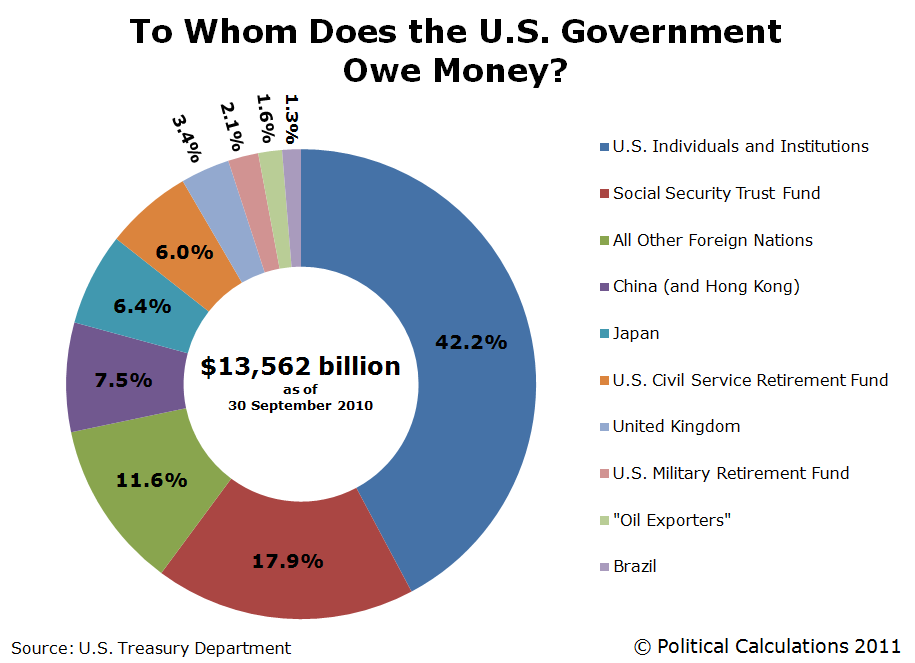

The main differences from the chart we previously featured are that China’s holdings are much greater — since we showed this chart back in January, China’s holding’s rose from 7.5% to 9.5% — and they now hold more US treasuries than does the U.S. Federal Reserve . . .

>

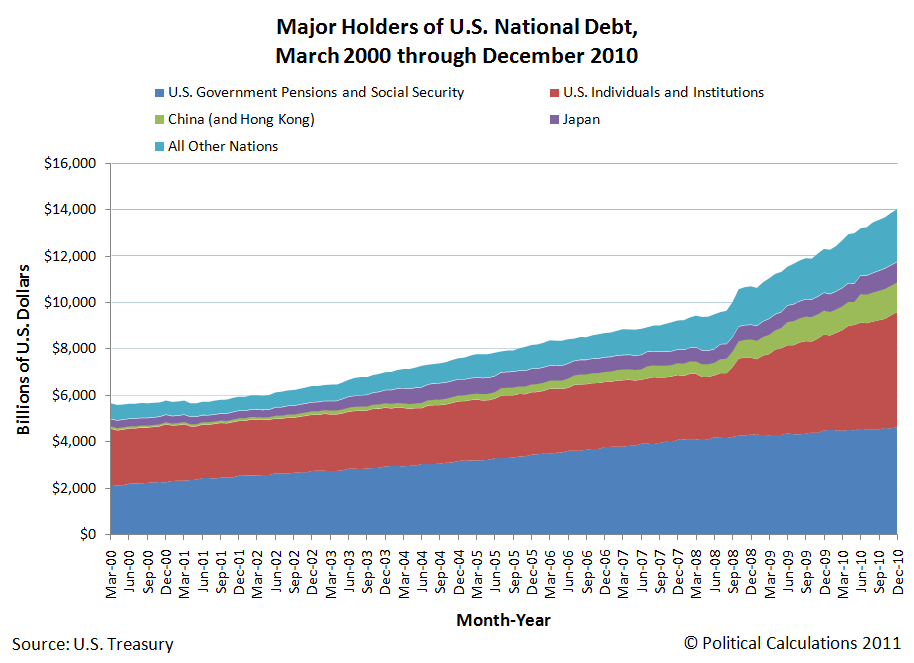

Last, if you want to see how this has changed over time, try this graph:

>

Previously:

Is China Really Funding the US Debt? (January 14th, 2011)

Source:

To Whom Does the U.S. Government Really Owe Money?

Political Calculations, March 15, 2011

http://politicalcalculations.blogspot.com/2011/03/to-whom-does-us-government-really-owe.html

What's been said:

Discussions found on the web: