>

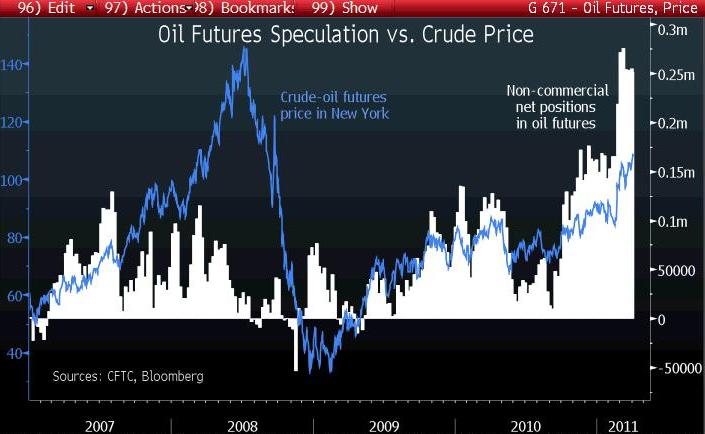

Fascinating chart above via David Wilson of Bloomberg.

It very much suggests that while Speculators may not have been the prime mover on the 2008 Oil peak, the specs seem to be a very large portion of the current push.

By comparing the net number of contracts owned by non-commercial oil traders (Source: Commodity Futures Trading Commission).

Crude 5.8% the first two days of this week, suggested that speculative demand for oil may be declining.

What's been said:

Discussions found on the web: