I have been wanting to discuss a horrifically misleading article for a week now: Americans Shun Cheapest Homes in 40 Years as Ownership Fades.

It is an object lesson in how an industry spokesgroup, engaging in biased analysis, used poor econometric models to create misleading data. That led to others making bad assumptions based on that data, which in turn leads to an unsupported conclusions. To wit, that home prices are now cheap (they are not) and home ownership is being shunned (it is not). Thus, the end result is a misleading Bloomberg.com article on residential Real Estate that is unfortunately based on these terribly flawed NAR metrics.

The reality is quite different than the spin. No, it is not, as objective data reveals, especially cheap.

This flawed data/PR flack/spin approach is how the NAR manages to get a false and misleading claims printed in major US media on an all too regular basis. “The most affordable real estate in a generation” nonsense in Bloomberg is only the latest hoodwinking they have pulled on journalists. Recall back in 2009, the Wall Street Journal and IBD were both snookered by the NAR’s seasonal adjustments (we discussed this here, here, here, and here).

Given the NAR’s track record when it comes to data analysis, anyone who makes any sort of purchase based on NAR spin is a fool who will get what they deserve.

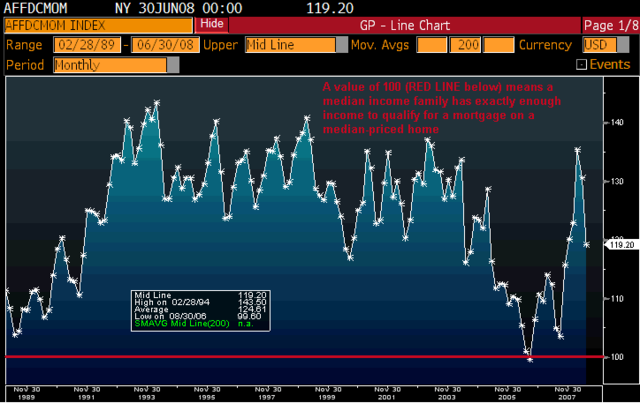

All of this leads to our present discussion of Home Affordability. Back in 2008, I wrote an analysis of the Realtors’ model titled “NAR Housing Affordability Index is Worthless.” As you can see from the chart below, during the entire boom period of 1996-2006, there was but ONE MONTH where the NAR index said homes were not affordable. Indeed, that chart period extends from 1985 to 2008 — there was but a single month of over-priced houses.

How on earth did home prices NEVER become UNaffordable during the greatest run up in housing prices ever in the United States history? What sort of model refuses to allow homes to ever be perceived as unaffordable? We could only get that sort of thing from an industry source.

Gee, do you think their bias impacts their index?

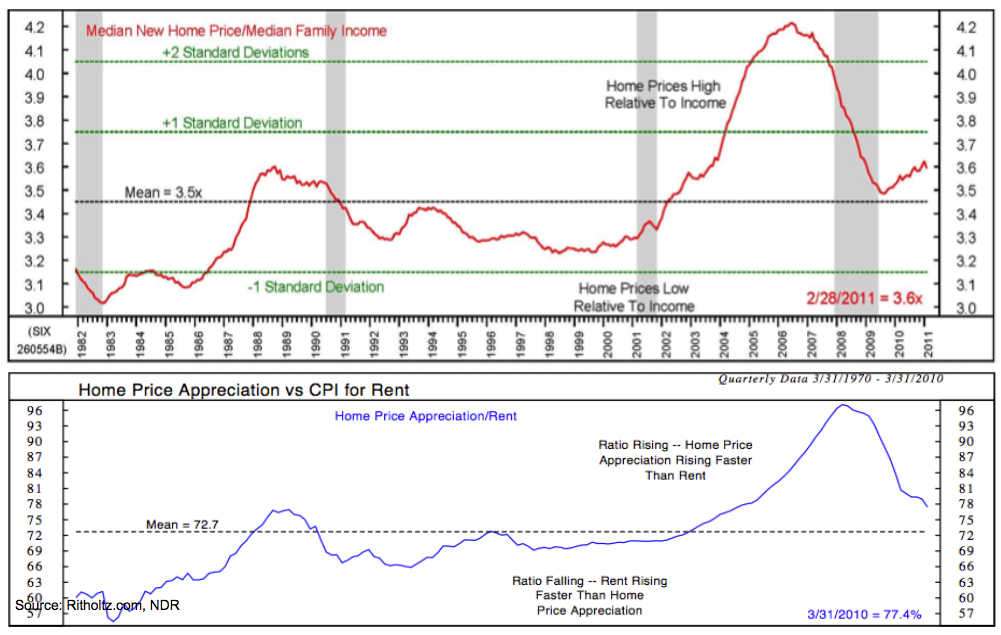

Rather than rely on their silly, indefendable model, I suggest you compare median income to median home prices (see NDR chart below).

That metric shows that homes are way off of their boom highs, but stilll remain somewhat overvalued relative to the buyers ability to pay for that home. If you were to measure affordability BUT ignore that metric (of ability to pay), what you will end up with is lots of new homeowners who cannot afford to pay for those homes. Which in turn leads to lots of foreclosures — which is exactly what has occurred here.

By comparing Homes costs with buyers ability to pay for them, we can instead develop a sustainable model with periods of over and undervaluation — something the NAR model seems incapable of doing. That would render the NAR methodology, as a valuation measure, to be without any redeeming factors; (I believe the phrase I used in 2008 was “Worthless.”)

I would argue the measure of Median income to Median home price a much better gauge. It tracks people’s ability to pay for homes — an important data point if you want to see a measure of affordability that also imagines not being foreclosed upon is a relevant part of affordability.

Further, consider this perspective: How ownership ran up when money was free and lending standards had disappeared. That was obviously unsustainable. The latest home ownership data more likely reflects typical mean reversion to normalized ownership rates, rather than a paradigm shift in home ownership. At least, that is the my conclusion, relative to the ownership data and reversion to normal lending standards.

Of all the media outlets to get suckered by a garbage datapoint, one would think Bloomberg would be the last. Perhaps its time for Bloomberg LLC to offer a refresher class on “Understanding data for Journalists” . . .

>

Median Incomes vs Median Home Prices

NAR Affordability Index: Never Unaffordable

>

Previously:

NAR Housing Affordability Index is Worthless (August 13th, 2008)

How to Read National Association of Realtors News Release (April 20th, 2011)

Source:

Americans Shun Cheapest Homes in 40 Years as Ownership Fades

Kathleen M. Howley

Bloomberg, April 19, 2011

http://www.businessweek.com/news/2011-04-19/americans-shun-cheapest-homes-in-40-years-as-ownership-fades.html

What's been said:

Discussions found on the web: