GE paid no taxes; Goldman Sachs paid $14 million last year. The GAO reported in 2008 that “two out of every three United States corporations paid no federal income taxes from 1998 through 2005.”

Companies have become all too astute at paying for loopholes which allow them to shift profits abroad, or move their gains (on paper) to foreign low-tax/no-tax nations.

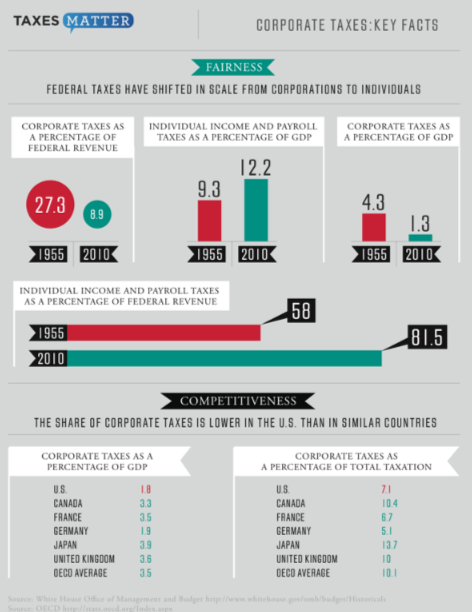

Since tomorrow is April 15th, it is a good time to look at the overall tax payments corporations have made. As the graphic below shows, the change in corporate taxes — not merely rates, but what they actually paid — over the past half century is astounding.

Corporate Taxes as a Percentage of Federal Revenue

1955 . . . 27.3%

2010 . . . 8.9%Corporate Taxes as a Percentage of GDP

1955 . . . 4.3%

2010 . . . 1.3%Individual Income/Payrolls as a Percentage of Federal Revenue

1955 . . . 58.0%

2010 . . . 81.5%

Anyone who is serious about closing the US deficit should consider the changes in what corporations pay in taxes and the rise of the deficit.

>

>

Source:

Loophole Land: Time to Reform Corporate Taxes

Graphic PDF

Demos, APRIL 12, 2011

http://www.ourfiscalsecurity.org/taxes-matter/2011/4/12/loophole-land-time-to-reform-corporate-taxes.html

What's been said:

Discussions found on the web: