The hand-wringing about the US dollar is rather late to the party.

The hand-wringing about the US dollar is rather late to the party.

Where were all you concerned dollar bulls earlier in the decade? It strikes me that like the late-to-discover inflation, you folks cannot spot a trend until it bites you in your collective asses.

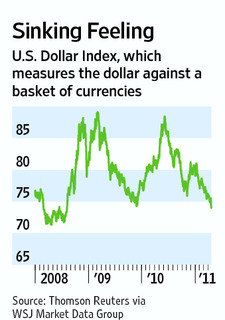

While the WSJ is upset that the dollar has been range bound between 72-87 the past 3 years, I strongly urge them to look at the 7 years before that.

Consider the following charts: The one at right was in today’s WSJ, and shows the US currency off by less than 20% over the past few years.

That’s not a dollar collapse; A fall from 121.02 in July 2001 to 70.69 in March 2008 — Now THATS a dollar collapse:

Source: Barchart.com

What's been said:

Discussions found on the web: