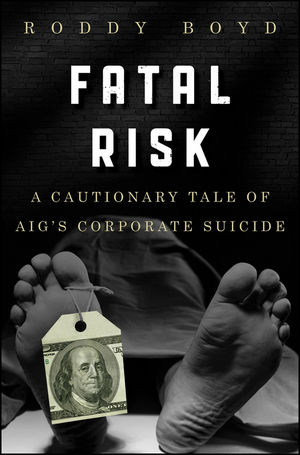

The latest book for your shelf of credit crisis reads is FATAL RISK: A Cautionary Tale of AIG’s Corporate Suicide by Roddy Boyd.

The latest book for your shelf of credit crisis reads is FATAL RISK: A Cautionary Tale of AIG’s Corporate Suicide by Roddy Boyd.

It tells the tale of how Goldman Sachs and AIG entered a pas a deux — an intertwined dance that became a ballet of death for one of them, and a source of great riches for the other.

Most people’s understanding of the 2007-2009 subprime crisis includes only as passing knowledge of the AIG saga. You may only have a passing awareness of how Goldman Sachs collateral calls brought AIG to the brink. Fatal Risk goes deep into the weeds to flesh out the specifics of capital markets subsidiary AIG Financial Products (AIG-FP) — how it was created, developed into a powerhouse, and eventually became the source of the lion’s share most of AIG’s profits — before it blew up, destroying AIG and helping to push the global economy to the brink.

Note the book is not for fans of Eliot Spitzer, who is blamed in part by the author for AIG’s collapse.

Reviews:

“Well-researched and highly readable account of the whole story behind the AIG disaster.” -Amazon

“Roddy Boyd is one of the good guys. If you haven’t read his stuff before in the papers/magazines in which he has written, you will benefit from his book on AIG.” –David Merkel

“Riveting read for anyone who wants to know the story of AIG and AIG Financial Products” -Amazon

Full chapter excerpt after the jump . . .

What's been said:

Discussions found on the web: