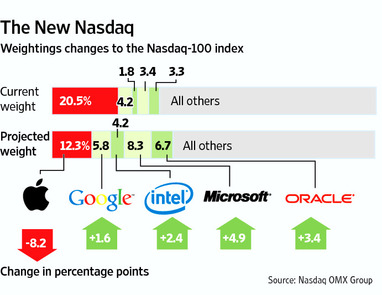

Nasdaq OMX is rebalancing the Nasdaq-100 index (QQQs), which currently has one company — Apple (AAPL) as more than 20% of the index.

The WSJ notes “Apple’s market capitalization is roughly $300 billion, twice that of Google. But its weighting in the index was five times that of Google. After the rebalancing, Google’s share of the index will be 5.8% compared to Apple’s 12.3%. Apple will remain the largest component of the index.”

No one should be surprised at this — it is long overdue. If I were running this, I would place a cap on the size any single stock can be in the index at 10%. Rebalance quarterly when it exceeds that level; monthly if it is exceeds it by 3%.

Beyond that, it is simply imprudent for any index to be a proxy for a single stock. The point of indexes is a broad based representation of a given sector or industry.

Apple has risen 4-fold over the past 2 years. Quite bluntly, it is surprising the OMX has waited this long . . .

>

courtesy of WSJ

What's been said:

Discussions found on the web: