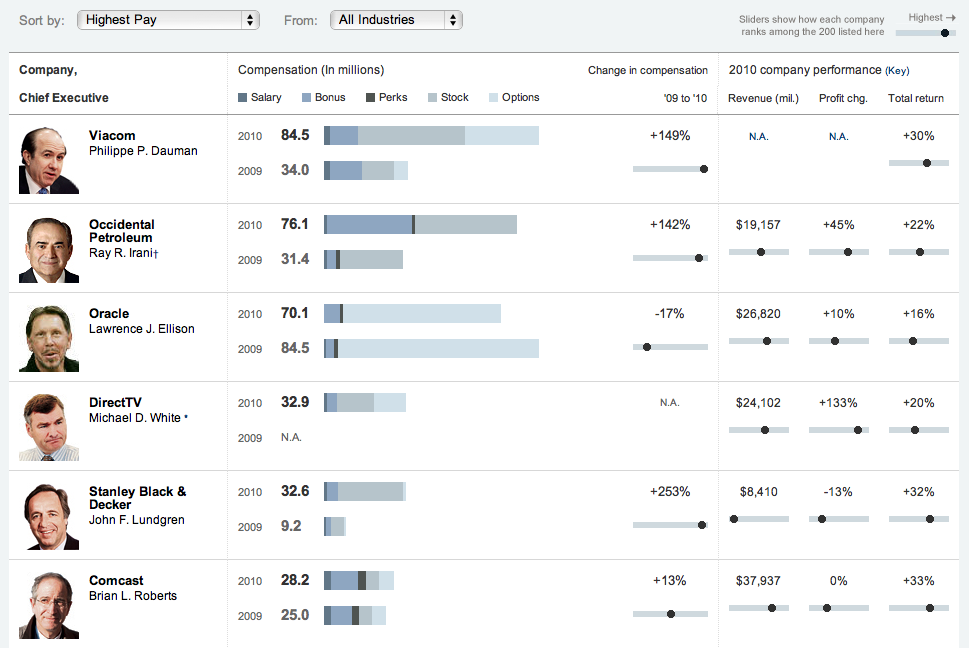

Following our QOTD is this interactive graphic from the Sunday NYT showing the relative compensation of 200 chief executives:

>

click for interactive graphic

>

Source:

The Drought Is Over (at Least for C.E.O.’s)

DANIEL COSTELLO

NYT, April 9, 2011

http://www.nytimes.com/2011/04/10/business/10comp.html

What's been said:

Discussions found on the web: