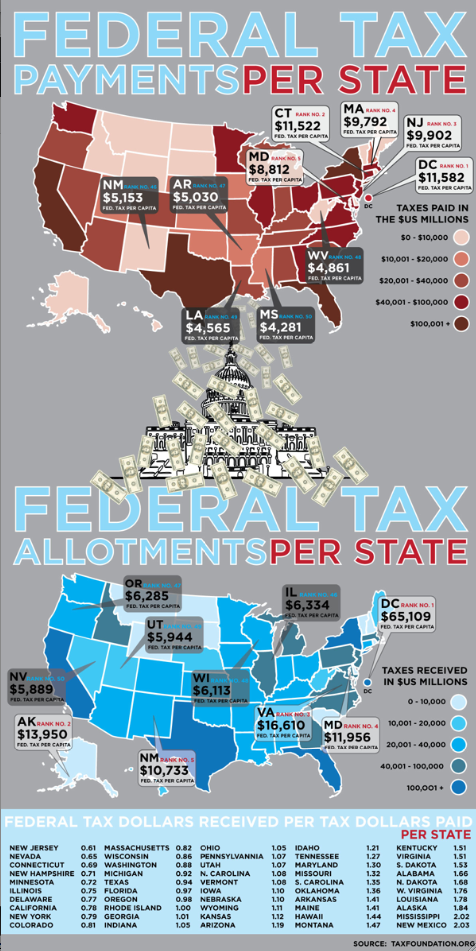

April 15th is but 10 days away, and that gives us an opportunity to post a giant tax graphic. Via Visual Economics comes this ginormous US map showing the total Federal tax dollar allotment made and received on a per state basis.The biggest states send and receive back the greatest allocation of dollars.

What really matters is the per capita breakdown; you can find those in the table at the bottom of each map

VE notes:

The federal taxes paid per capita vary widely by state. New England has some of the largest tax payments per capita while the states with the lowest per-capita payments are scattered elsewhere in the country.

The place with highest federal tax payments per capita is Washington, D.C., with $11,582. The state with the second-highest federal tax payments is Connecticut with $11,522 per capita. The state with the third-highest federal tax payments is New Jersey with $9,902 per capita. The fourth-highest federal tax payments per capita come from Massachusetts with $9,792. The state with fifth-highest federal tax payments per capita is Maryland with $8,812.

The state with the lowest federal tax payments is Mississippi with $4,281 per capita. The state with the second-lowest federal tax payments is Louisiana with $4,565 per capita. The state with the third-lowest federal tax payments per capita is West Virginia with $4,861. The state with the fourth-lowest federal tax payments per capita is Arkansas with $5,030. The state with the fifth-lowest federal tax payments per capita is New Mexico with $5,153.

Surprising that many of the states that have the highest net tax gain are in favor of less government spending, while the states that reap the least per capita are more government spending . . .

What's been said:

Discussions found on the web: