In one of the model portfolios we run, there are 5 best of breed mutual funds.

But one of the holdings in the group, Fairholme Funds, managed by Bruce Berkowitz, has seen some recent changes. The manager became a champion of real estate developer the St. Joe Company (JOE). The fund now owns a whopping 29% of the company.

Berkowitz has become a director and chairman of JOE. He is battling Greenlight Capital’s David Einhorn over the stock. Einhorn laid out his case for why he is short St. Joes (here), and believes it should be trading under $10.

From an investor’s perspective, all of the above is nonsense. It appears to have been a distraction to Berkowitz, and Fairholme Funds performance has suffered.

So we fired him.

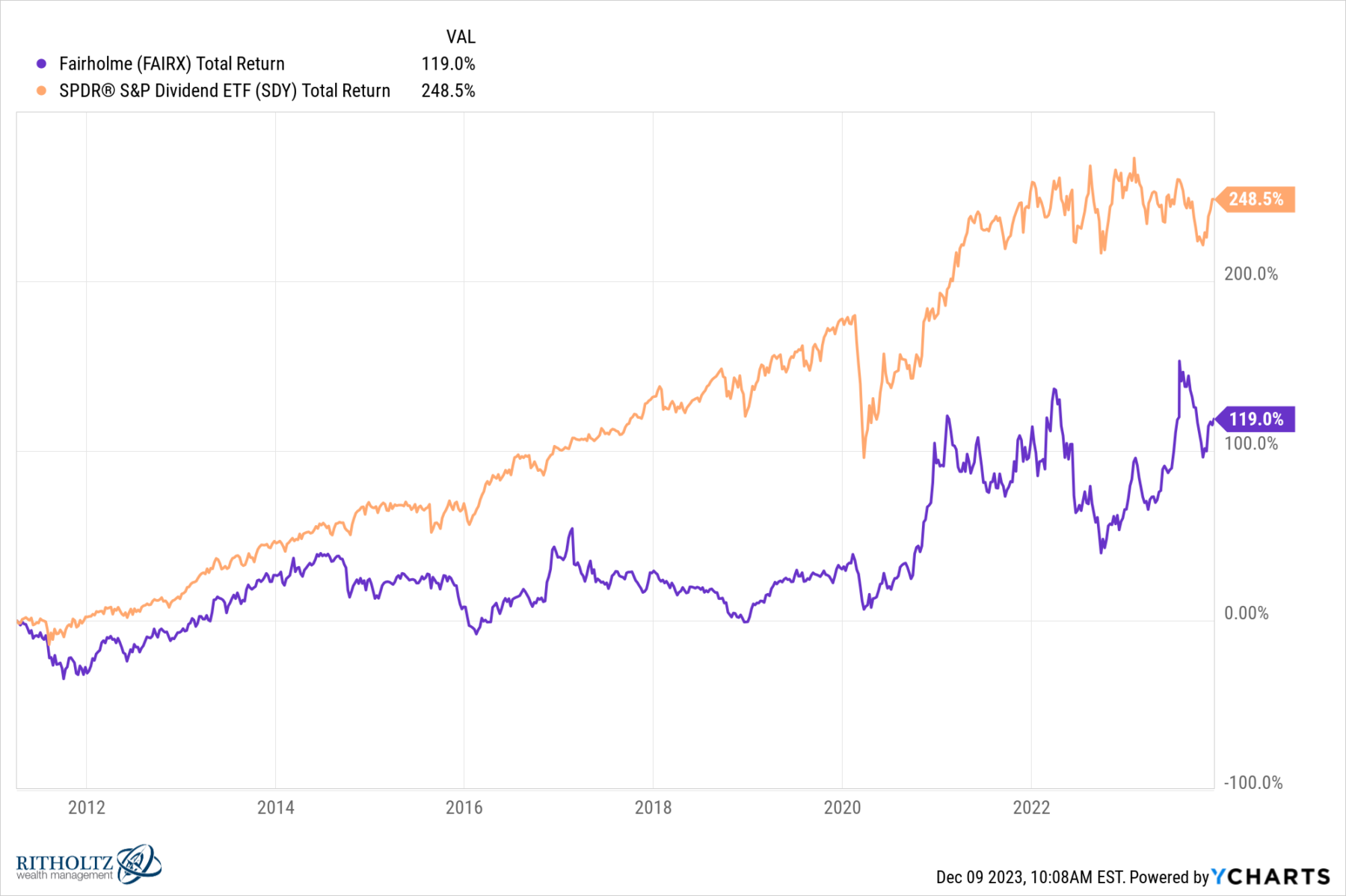

To be blunt, I have no interest in the outcome of this fight, These are two smart guys, and both are excellent managers. But I don’t want client’s to be the kids caught in the middle of a divorce, collateral damage of two parents arguing. Its a huge distraction, and it is not why we selected Berkowitz’s fund in the first place. It was easy to replace his value fund with the dividend SPX index (SDY), which cut the management fees to the investor by 60%.

But it raises an interesting question: When do you fire your mutual fund manager?

Here are my 5 criteria:

• When they suffer from style drift: This happens quite often; a manager developed an expertise in a given areas, but is looking beyond that. Maybe they got bored, maybe the new cow in the pasture caught the bull’s eye. Whatever it is, they are doing less and less of why you bought them int he first place. That’s a signal to move on.

• When they become too big: Some managers find a niche that they can profitably exploit. But beyond a certain size — and that can range from $1 billion to $5 billion dollars — they no longer can create alpha with that strategy. This may be true for eclectic segments like convertible arbitrage, but I have found its especially true for small cap and emerging technologies.

• When they fight the dominant market trend: Bill Miller’s streak came to an end amidst a value trap. He bought more and more of his favorite holdings — banks, GSEs and investment houses — right into the financial collapse. Doubling down again (and again) is not a valid investment strategy. Whatever advantages he had heading into 2008 disappeared.

• When they become a closet indexer: When a fund owns 100, 150, 200 names, they effectively become a high cost index. Even if they have the top performing stocks, it will be in such small quantities as to not move the needle. This is an easy fix — you replace them with a low cost, passive index.

• When they seem to lose their edge: Whether its success or money or a loss of interest, managers sometimes lose the fire in the belly. Determining this is admittedly challenging in real time, and we often find out after the fact about some personal issues.

Notice that Performance is not a factor in any of the 5 bullet points above. There are two reasons for that

1. Process, not outcome: I want to be focused on creating a reproducible methodology, regardless of luck or misfortune in any given quarter. Investing is a probabilistic process, and performance can slip for a quarter or two even when the manager is doing everything right.

2. Mean Reversion: The opposite of chasing performance (and buying high) is dumping a weak quarter (selling low) that then snaps back.

These are my reasons to be replace a formerly favored active manager with another vehicle. What are your reasons?

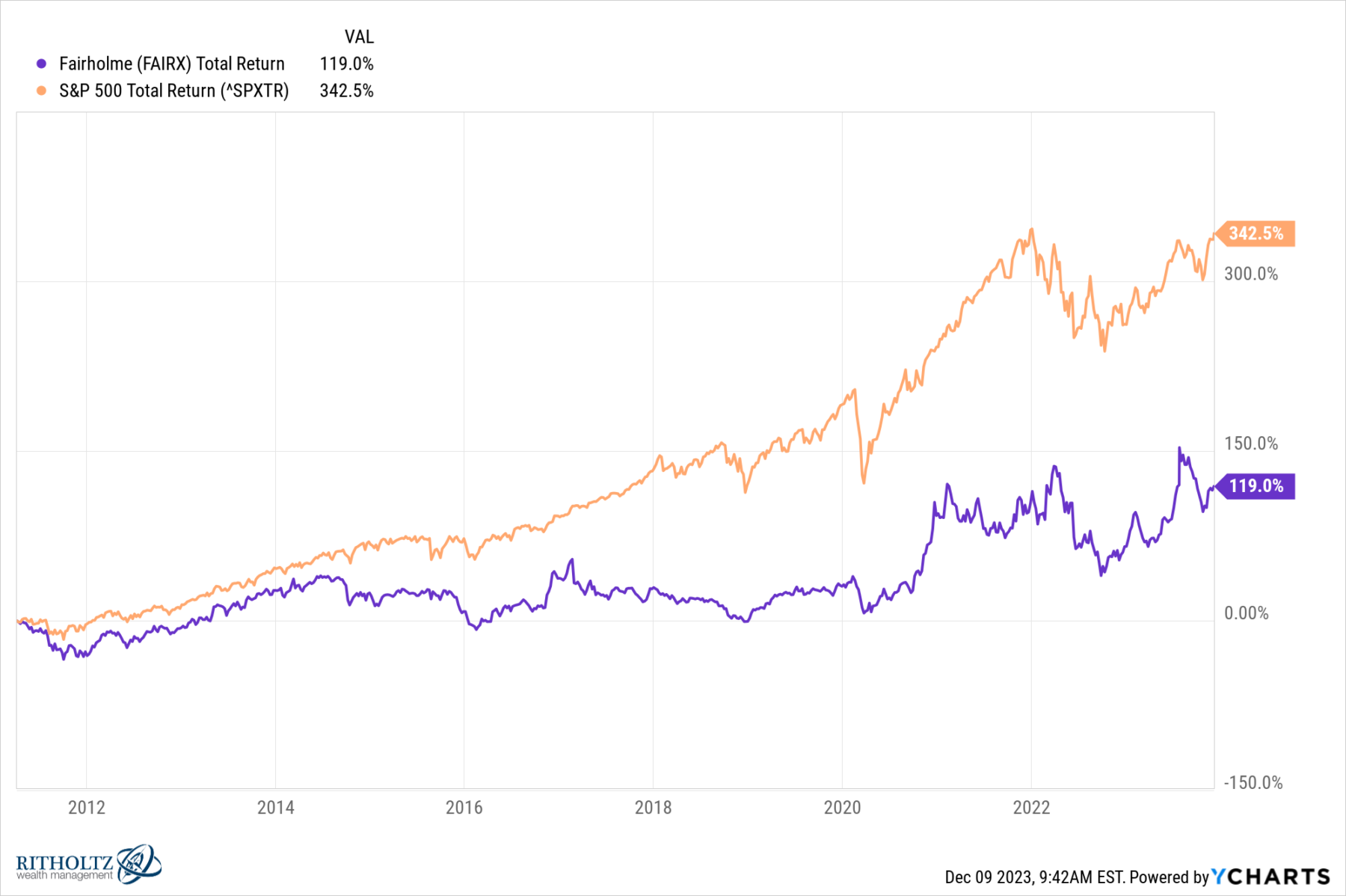

UPDATE 3: December 9, 2023

Here is what this looks like since this was published in 2011

FAIRX vs SPY

UPDATE 2: February 18, 2021

Bruce Berkowitz: From Morningstar Manager of the Decade to 15 Years of Underperformance (Canuck Investment Analyst, February 17, 2021)

UPDATE: May 8, 2011

When should you fire your mutual fund manager? (Washington Post, May 8, 2011)

What's been said:

Discussions found on the web: