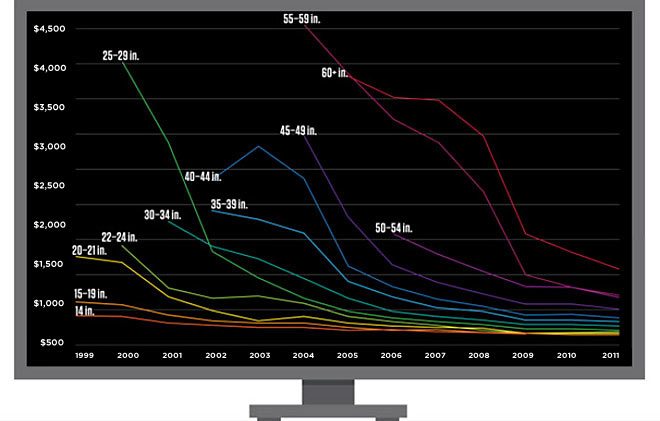

Plummeting prices of LCD screens, via this month’s Wired.

>

With everyone so focused on Inflation, I (naturally) want to discuss Deflation. Or rather, the lack of it in Technology prices. Instead, lets look at the Recency Effect and the life cycles of new tech products.

Technology poses a special challenge to the hordes of inflation watchers — Larry Kudlow calls them inflationistas. During the 2000s, this crowd completely missed the biggest inflationary spike since the 1970s until Oil was well over $100 and foodstuffs had skyrocketed. This was after decades of ignoring ballooning medical and college costs.

Having missed the last run up in prices, this same crowd now sees hyper-inflation everywhere.

There seems to be an inability to understand how CPI is officially constructed, and why it typically understates inflation. Complicating matters is the challenge of recognizing the impact of Technology, and how it create the appearance of deflation.

The key is understanding Technology’s normal adaptation cycle, what this means for cyclical pricing declines, and why falling prices do not automatically equate with Deflation.

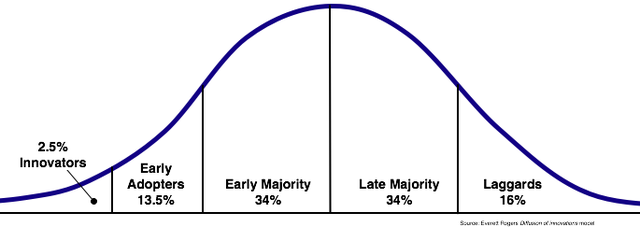

The Fed gets this wrong. Wall Street misunderstands this. Most economists seem not to recognize qualitative difference between the 1st Big Screen TV that rolls of the assembly line and the 10 millionth. (Those who want to delve into the finer wonkish points about this can see the Technology adoption lifecycle by Joe M. Bohlen and George M. Beal, (1957), later refined in Everett M. Rogers’ Diffusion of Innovations).

Consider this simple factoid: New technologies and products come down in price over time, regardless of the state of the economy, Fed monetary policies, Federal stimulus, or even income inequality in the broader society.

If tech prices are independent of the Fed and Congress and money supply and the value of a dollar, then its hard to say (as so many do) that this is deflationary per se. It is a simple fact of adoption cycles, and not the usual drivers of inflation.

Whether we are discussing washing machines, radios, auto airbags, cellphones, or even PCs — all manufactured goods go through a well established adoption process. In the classic definition (see chart below), the first group of people to use any new technology are called “innovators,” followed by “early adopters,” then the “early majority” and “late majority,” and lastly, the “laggards.”

>

Technology Adoption Lifecycle

>

The key to understanding this is recognizing the differences in perceived social status value of these products.

The impact of this adoption process and the manufacturing economies of scale are significant determinant of technology product prices. But understand the following: What the Innovators buy is a very different product qualitatively — in terms of social status and perceived value — than what the laggards purchase.

Here is a grossly over-simplified version of how this works: When innovators buy a product, they essentially pay for all of the R&D costs, and other development expenses. You paid 365 labor units for a VCR in 1972 because they were a limited production, custom product that was practically hand made. When a PC cost 465 labor units, chip fabs were nowhere near as plentiful as today — and the biggest cost in early PCs were the exorbitant chipsets contained in them.

Let’s take a closer look at the perceived social status value of these products: When you are the only person in town in 2000 who has a 50 inch flat screen TV — and it cost $10,000 — there are non-monetary, status benefits of ownership. Compare that in 2010, when EVERYONE has a big screen, thanks to the cheap Korean flatties sold for less than $600 at Best Buy.

The claim that the price drop is deflationary assumes these two products are nearly identical, and further ignores irrational human behavior regarding these early innovator purchases. These products are not identical, at least in terms of the value conferred social value of status-seeking consumers.

The early adopters pay less than the innovators, as factories get built to mass produce chips or tape transport mechanisms or cell phone keypads. But they also buy a product with lower social status. What was a nearly custom made product becomes a merely limited-production, high-end one. Where the innovators paid for the R&D, the early adopters paid for the fabs and factories to be built.

Recall the days before cell phones were ubiquitous: The early majority doesn’t get the use of the product for the first few years, but they get a big price benefit of manufacturing economies of scale. But they also did not get the status symbol of those giant beige Motorola brick phones with their 8 inch black antenna. Mass production of components bring prices down; successful products attract competition to the space, and soon more manufacturers are cranking out more units. Through competition, prices begin dropping faster and faster. The late majority gets even cheaper prices. Consider the laggards and the VCR today — they cost about $29 each.

Recall the days before cell phones were ubiquitous: The early majority doesn’t get the use of the product for the first few years, but they get a big price benefit of manufacturing economies of scale. But they also did not get the status symbol of those giant beige Motorola brick phones with their 8 inch black antenna. Mass production of components bring prices down; successful products attract competition to the space, and soon more manufacturers are cranking out more units. Through competition, prices begin dropping faster and faster. The late majority gets even cheaper prices. Consider the laggards and the VCR today — they cost about $29 each.

But the status associated with being the very first to own this is why the Innovators pay more for these products. And its also why the 100 millionth 50 inch television screen to roll off the assembly line has no status associated with it — where has the first few 1000 had massive status attached to it.

Technology adoption cycles reflect this in their price changes. Technology price decreases across their production life cycle are not only about industrial economies of scale — they are also about the decreasing status of an object as it becomes an everyday household product.

>

Previously:

Hackonomics (February 2008)

What's been said:

Discussions found on the web: