Fun with Gold Bugs . . .

An old friend swung by the office today to chat. She is a rather well known in certain circles, a savvy investor who has done very well...

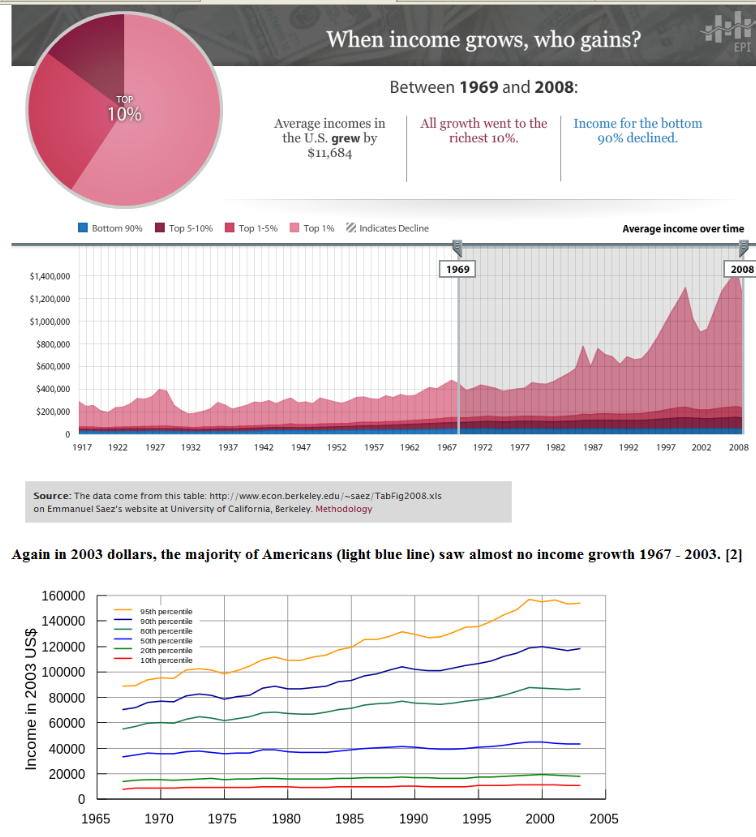

Insane collection of charts, not-so-painstakingly assembled by minus — min.us — found via Digg; What makes min.us so...

Insane collection of charts, not-so-painstakingly assembled by minus — min.us — found via Digg; What makes min.us so...

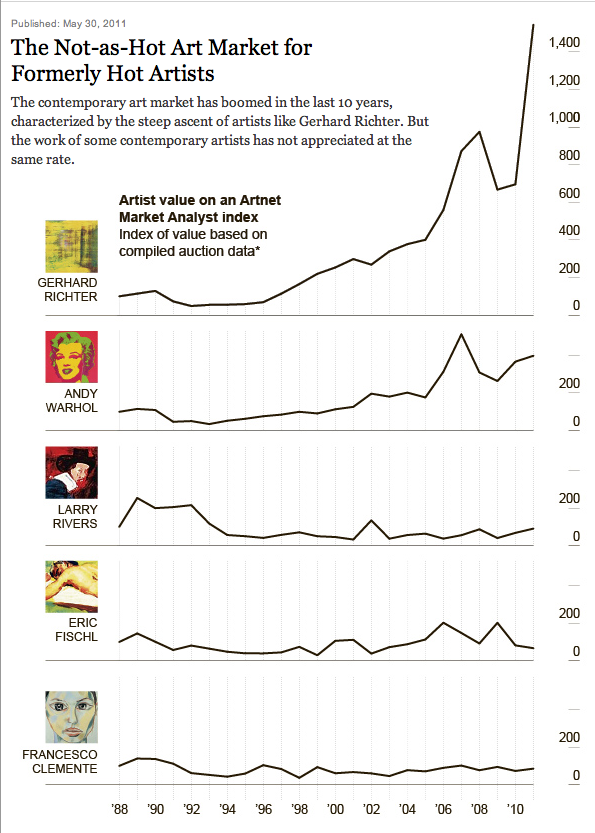

One of the biggest problems caused by the Contemporary Art market boom of the last 13 years is the ways in which it has confused the...

One of the biggest problems caused by the Contemporary Art market boom of the last 13 years is the ways in which it has confused the...

> Since we have the NFP report at the end of the week, I thought it might be instructive to use our lunchtime chart slot each day to...

> Since we have the NFP report at the end of the week, I thought it might be instructive to use our lunchtime chart slot each day to...

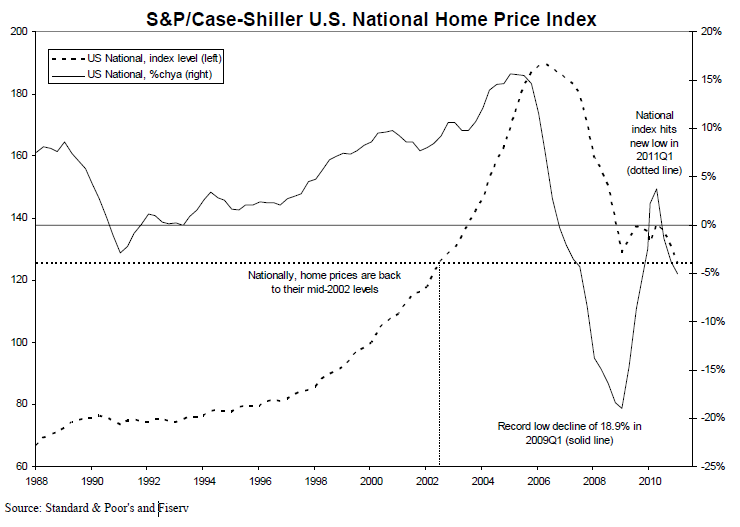

Case Shiller is out, and it confirms what we have known for quite some time: Without artificial government stimulus, Housing is going...

Case Shiller is out, and it confirms what we have known for quite some time: Without artificial government stimulus, Housing is going...

Get subscriber-only insights and news delivered by Barry every two weeks.