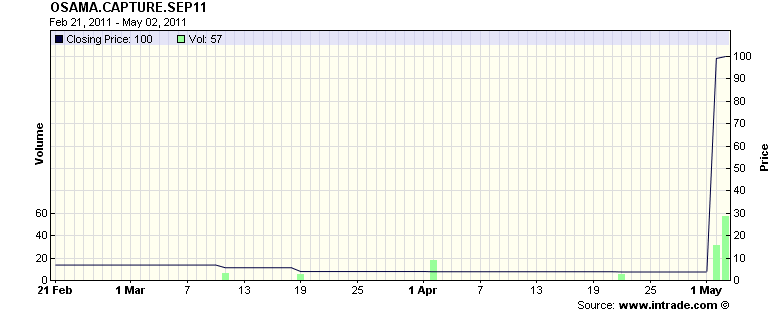

via InTrade

>

Economix discusses one of my long-standing peeves: Prediction markets that do not predict, but instead, essentially “poll” their traders, and claim these are forecasts.

When the members of those groups whose trades are polled are similar in makeup and character to the decision makers they are attempting to forecast, they actually do fairly well; this is similar to traditional polling. When the traders differ from the decision makers they are attempting to forecast, their efficacy can approach zero.

Hence, these markets have the potential to better predict elections than they do Jury Verdicts, Corporate Board Decisions (recall the Michael Jackson verdict, or the Morgan Stanley CEO Purcell resignation betting).

Which brings me to the latest failure of prediction markets to actually predict: The “Osama bin Laden “captured/neutralised before midnight ET on 30 Sep 2011″ contract. As of Sunday night at 10:24PM (EDT) this contract was trading at 7.1 cents. 30 minutes later, it was at 99.1 cents.

Not exactly what you would call highly efficient prediction — is there a word for forecasting what has already happened? I mean, other than “History” ? Apparently, special ops and military ventures are not their strongest suits.

Or as Catherine Rampell observed, “Just goes to show that with imperfect information it’s hard for markets to be terribly efficient.”

>

Previously:

Misunderstanding Prediction Market Failures (February 14, 2007)

Why Prediction Markets Fail (January 11, 2008)

Source:

Bin Laden and Inefficient Markets

Catherine Rampell

Economix May 2, 2011

http://economix.blogs.nytimes.com/2011/05/02/bin-laden-and-inefficient-markets/

What's been said:

Discussions found on the web: