The regular debt ceiling limit dance seems to evoke a fairly standard set of behaviors in the two major US political parties: Whichever party is out of power (White House, or Congress or both) threatens not to support raising the debt ceiling. Which ever party is in power talks about how irresponsible and dangerous such a move would be.

The regular debt ceiling limit dance seems to evoke a fairly standard set of behaviors in the two major US political parties: Whichever party is out of power (White House, or Congress or both) threatens not to support raising the debt ceiling. Which ever party is in power talks about how irresponsible and dangerous such a move would be.

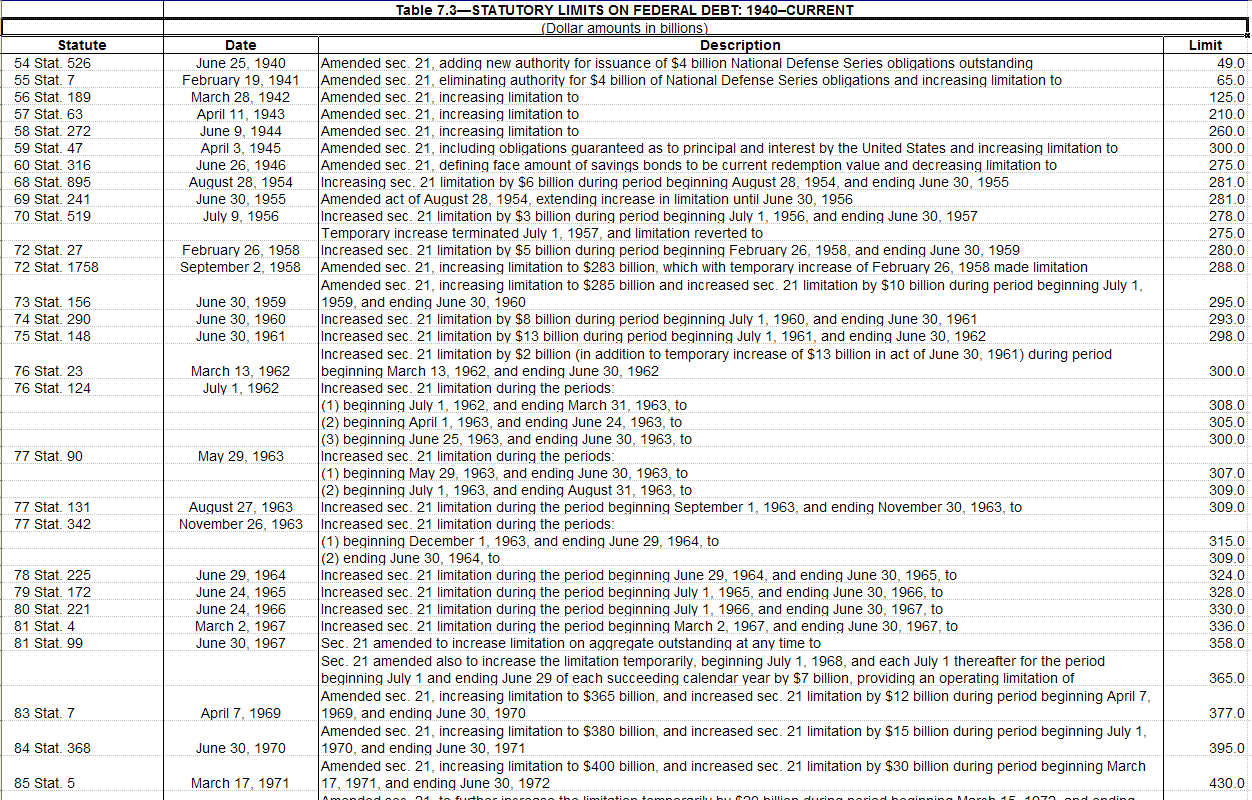

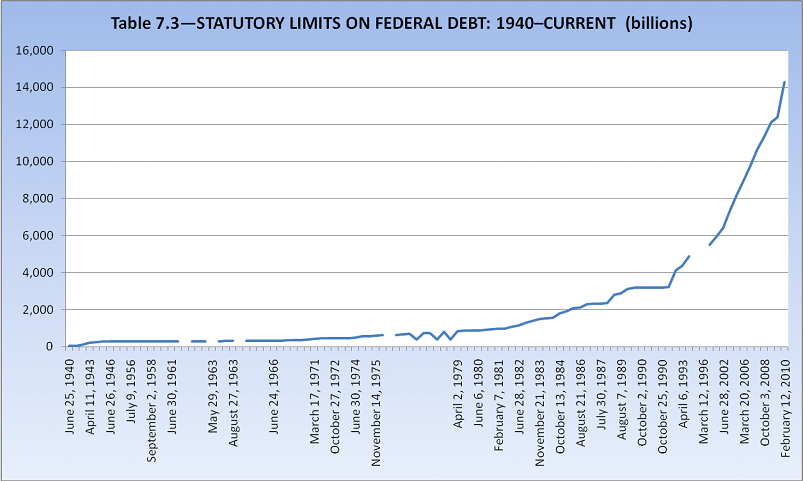

The historical statutory debt ceiling increases (sourced from Table 7.3 here; click graph for Spreadsheet) reveal this game has gone on for more than half three quarters of a century.

To put this into context, consider the following quote:

“The Republican-dominated Senate voted tonight by 64 to 34 to raise the Government’s borrowing authority to more than $1 trillion for the first time in history. The vote to raise the debt ceiling, to $1,079 billion, will allow the Government to start its new fiscal year Thursday with sufficient funds in its coffers to pay its bills . . .

Although the routine increase in the debt ceiling was essential to meet Government obligations already incurred, the vote is traditionally delayed to the 11th hour, with the minority party accusing the party in power of spendthrift ways.” (emphasis added)

That quote may surprise you. It comes from the NY Times, Sept. 30, 1981, defending President Reagan and blaming the Democrats in Congress for playing games with the debt ceiling.

We can skip the usual debate, and go straight to the data. Pulling the historical increases in statutory debt authority, the chart below shows what the increase in spending limits has looked like:

>

click for larger graphic

Hat tip Bruce Bartlett, Invictus

>

To give you a sense of the present absurdity, consider the following fairly random survey of past pronouncements on raising the debt ceiling limit from 1939 forward:

• Boost for Debt Limit Ditched -Roosevelt Calls on Congress, However , to Remove Curb on Issue of Bonds (March 20, 1939)

The Milwaukee Journal: President Roosevelt informed congress Monday that there is no present necessity for legislation to increase the legal limitation of $45,000,000,000 on the toal public debt, but recommended increase of the present $30,000,000,000 limitation on outstanding government bonds. The special message transmitted a letter from Treasury Secretary Morgenthau informing thim that the current balances of the treasury indicate no immediate necessity for advancing the debt ceiling. Monday’s treasury statement showed that the debt was $39,948,995,124

~

• PRESIDENT URGES ENDING OF LIMIT ON BONDED DEBT; Asks Congress to Facilitate Borrowing by Eliminating $30,000,000,000 (March 21, 1939)

President Roosevelt told Congress today that there was no immediate need for raising the $45,000,000,000 limitation on the public debt. He asked, however, that the $30,000,000,000 “ceiling” on Treasury bond issues be removed.

~

• The Debt Taboo Is Lifted (November 9, 1940)

The Portsmouth Times: Treasury Secretary Morgenthau officially opens post-campaign business with an announcement that he is going to ask congress for a public debt limit of either 60 or 65 billion dollars. That is a matter which could not have been discussed conveniently in advance of Election Day, but must be discussed now. Like the skeleton in the closet it can’t be kept hidden forever.

The gross public debt now stands at $44,140,689,112 about three billion more than it was a year ago. The existing legal debt limit is 45 billion dollars; there is no more leeway for debt increase. The debt has reached its legal ceiling by rising steadily since 1931, when deficit financing began. During the Roosevelt administration it has increased 100 per cent – from $ 22,538,672,174 (June 30, 1933) to almost twice the amount.~

• $65,000,000,000 Debt Limit Voted; Senate Critics Deny It Is Enough; HIGHER DEBT LIMIT IS VOTED BY SENATE (February 15, 1941)

The Senate approved today, with slight changes, the House bill to raise the national debt limit to $65,000,000,000, a ceiling which, according to Administration spokesmen, will suffice until June 30, 1942, at least.

~

• Boosting the Debt Ceiling (May 10, 1944)

Pittsburgh Post-Gazette: The ease with which House Republicans cut the Treasury’s request for a debt ceiling of 260 billion to 240 billion suggests that 20 billion dollars more or less is not worth fighting over in time of all-out war.

Accepting the cut without an argument, the Treasury spokesman Daniel W. Bell, just reminded the House Ways and Means committee that the debt ceiling would have to be raised still again if and when the new limit is reached.

With the national debt already standing at approximately 187 billion and slated to reach the 240 billion mark next March, this business of raising the limit by successive jumps instead of taking it off altogether is little more than a psychological gesture. By holding that flexible limit over the Administration’s head, perhaps some congressmen feel that they will exert pressure on some officials to hold down expenditures. But since those officials know as well as the congressmen that the debt limit is going up and up until the war is won, maybe this economy gesture is intended only for public consumption.

~

• Senators Favor Debt Limit Cut (April 24, 1946)

St. Petersburg Times: The first step to cut back the limit of what the federal government might owe, from its historic high of $ 300,000,000,000 was taken yesterday by the senate finance committee. The committee voted to reduce the public debt limit to $275,000,000,000. Its unanimous action forecast congressional approval for the first reduction in the debt ceiling, pushed upward steadily during the war years.

~

• Increasing National Debt Limit Now Seems Inevitable (September 2 , 1953)

The Spencer Daily Reporter: It will be the end of September before Eisenhower administration leaders will know whether they must call a special session of Congress this fall to increase the national debt limit. If Sept. 15 income tax payments are high – If new loan offering are fully subscribed – If the administration’s expense can be cut further – And if no new world crisis develops requiring a large new outlay of cash – Then and only then will it be possible to say that no special session of congress will be necessary.

~

• Extension of National Debt Ceiling Voted; House Action Leaves Limit at 281 Billion for Year (June 28, 1955)

The Lewiston Daily Sun: The House voted 226-56 today to continue for another year the “temporary” 281 billion dollar limit on the national debt. The Senate is expected to act by Thursday: without congressional action, the limit would fall back then to 275 billion. Democrats got in some additional cracks at the administration on its handling of government finances before the extension sailed through on the 170 vote margin in the House.

~

• The Federal Debt Ceiling (July 26, 1958)

“A specter that has been putting in an appearance more or less regularly every year now since 1953 is again back to haunt the Administration. That is the problem of keeping the public dept within the dept ceiling – a problem that will be additionally complicated in the present fiscal year at least by the prospect of a very substantial budget deficit.

The dept ceiling is a comparatively new instrument of fiscal control in this country. In 1938, with the dept then standing at what many regarded as the dangerously high level of $37 billion, Congress acted to discourage future reckless spending by setting a limit on the debt of $45 billion. During the ensuing eight years, most of which were marked by war or preparation for war, Congress had little choice but to revise this limited ceiling upward when such action was requested by the President. The ceiling was lifted five times in that period, until it reached $300 billion in 1945. A year later it was revised downward for the first time to its present level of $275 billion.”

~

• $308 Billion Debt Ceiling is Approved (June 15, 1962)

The Pittsburgh Press: The House has approved President Kennedy’s request to raise the national debt ceiling to a record 308 billion dollars after rejecting a Republican effort to trim the hike.

The vote on final approval late yesterday was 210 to 192, an 18-vote margin.

Asked whether Republicans were justified in charging the Pentagon had tried to “black mail” them into supporting the bill, President Kennedy said he hoped everyone understood the possible effects of failing to raise the limit.

~

• Another June Rite: Raising Debt Limit (June 10, 1966)

Eugene Register–Guard: Raising the national debt limit has become a June rite in Congress. This year the only doubt about it is whether the ceiling will be boosted by $2 billion or $4 billion. Congress already has approved the projects and voted the appropriation that will call for today’s federal debt to rise – as it has been doing year after year. The United States Treasury says it needs a $332 billion limit to give it elbow room to maneuver and be sure of paying its bills. The House says $330 billion is enough. The Senate will discuss the question next week.

~

• US Seeks loans to pay its Bills (January 31, 1967)

Pittsburgh Post-Gazette: Secretary of the Treasury Henry H. Fowler told Congress today that the government would be unable to pay all its bill if the ceiling on the national debt was not lifted within 30 days.

Fowler ran into Republican hostility in day-long testimony before the House Ways and Means Committee — not on the need to raise the limit but on the government’s debt and budget accounting methods as well as related matters.

Fowler asked that the ceiling be raised by $7 billion to $337 billion to cover the period until June 30. Further legislation covering the period after June 30 will be needed later he said.

~

• U.S. Raises Ceiling on National Debt (April 3, 1979)

The Montreal Gazette: The U.S. House of Representatives passed legislation yesterday extending the government’s borrowing authority and preventing the U.S. from defaulting on its debts for the first in its history.

The vote to accept Senate amendments and to send the legislation to the White House was 209-165. It came after the House rejected, 216-160, a Republican-led attempt to tack on a strong amendment calling for a balanced federal budget.The House vote came after U.S. Treasury Secretary Michael Blumenthal claimed in a letter that the treasury was on the verge of a default and that retired persons would be hit first.

About $8 billion in Social Security cheques already had been mailed to 35 million Americans, Blumenthal said, and there would be no funds to cover them if the House failed to act. In addition, he said, the treasury would not be able to pay civil service retirement benefits, veterans benefits and railroad retirement benefits due for collection today.

~

• Congress Asked to Hike Debt Ceiling (May 26, 1970)

Palm Beach Post: The Nixon administration asked Congress yesterday for an $18 billion increase in the national debt ceiling primarily because the slumping economy is producing lower than expected federal income. The administration asked Congress for an $418 billion increase in both the permanent ceiling no at $365 billion and in the temporary ceiling of $377 billion the government is operation under this fiscal year.

Treasury Secretary David M Kennedy and Budget Director Robert P Mayo told the Ilouse Ways and Means committee the increase was needed to cover a $1.8 billion deficit this fiscal year and $1.3 billion deficit in fiscal 1971

~

• Senate may meet tomorrow on debt limit, election reform (Dec 1, 1973)The Miami News: The federal government’s debt is $63 billion over the legal limit and the Senate is preparing for its first Sunday session in 112 years – all because of a tangle created by an election reform measure.

Despite the government’s technical violation, officials said bonds and other government debts could be paid off over the next few days out of about $4.5 billion in cash on hand.

~

• CONGRESS ADOPTS NEW DEBT CEILING; Ford Gets Bill to Increase Limit to $595 Billion (November 14, 1975)

After a partisan dispute and a last-minute appeal by Speaker Carl Albert, the House of Representatives narrowly approved today a bill increasing the Government’s debt limit.

~

• Rise in Debt Limit Approved in House (Oct 5, 1977)

Youngstown Vindicator: Concerns about the government being unable to borrow more money can be set aside. The ceiling on the national debt will be raised.

But a congressional stalemate over raising the debt caused some uneasy moments at the Treasury Department. The government also had to do some juggling of the books to hold its auction of short term treasury bills to investors on Monday. The loan from the Federal Reserve pushed the national debt almost to its limit, teaching $ 699.96 billions dollars.~

continues after jump

~

• Reagan Signs Increase In Federal Debt Ceiling (October 1, 1981)President Reagan tonight signed legislation raising the Government’s borrowing authority above $1 trillion for the first time.

Mr. Reagan signed the law without comment at 8:15 P.M., assuring that the Government would have enough money to pay its bills at the start of the 1982 fiscal year, which begins tomorrow.

~

• SENATE DEFEATS BILL TO INCREASE DEBT CEILING (November 1, 1983)

The Senate, in an extraordinary and unexpected move, defeated a bill late tonight to raise the nation’s debt limit, leaving the Treasury without the authority to borrow.

The defeat, with both Republicans and Democrats voting against the bill, came on a vote of 56 to 39 just after 11:30 P.M. Although there is no immediate threat of shutting down the Government, the Senate defeat left unclear whether the Senate would be able to approve an increase in the ceiling in time to prevent a serious disruption.

Twenty-five Republicans joined 31 Democrats in voting against the bill. Twenty-eight Republicans and 11 Democrats voted for it.

The defeat was seen by some Republicans and Democrats as a way to put enough pressure on the White House and the Congress to get both to agree on some major measures to reduce the projected Federal budget deficits through spending reductions, tax increases or both.

~

• Time Bomb in the Debt Ceiling (May 04, 1987)

There is a time bomb in the national debt ceiling, set to go off at midnight May 15. If a new and higher ceiling has not been set, or the current ceiling extended, Government borrowing must stop and the United States will slide quickly into default.

Unthinkable, but that’s how Congress wired the debt limit law last October. Each year Congress goes down to the deadline, then lifts the ceiling. But the game is trickier this year, and could have more serious consequences. Congress threatens yet another crisis to rattle already-worried financial markets. What’s needed instead is a simple bill to raise the ceiling, with dispatch and no strings.

The ceiling is a sham. It has no effect on the debt. Deficits create debt; the Reagan deficits have more than doubled the national debt, to $2.25 trillion, ceilings notwithstanding. Each time Government borrowing gets close, the ceiling is raised – but not without costly eleventh-hour shenanigans that force the Treasury into devious financing.

~

• REAGAN URGES A RISE IN DEBT CEILING (May 12, 1987)

Warning of dire financial consequences, the White House urged Congress today to raise the national debt ceiling before the Government runs out of authority to borrow money this Friday.

”We cannot overestimate the effect of such a dereliction of duty,” Marlin Fitzwater, the President’s spokesman, said.

But a number of conservative Republicans refuse to heed the Administration, and White House legislative strategists say they do not have the votes to assure passage of such a measure.

Periodic Ritual: The fight to raise the debt ceiling is a periodic ritual on Capitol Hill, and every battle is surrounded by predictions of fiscal ruin. Accordingly, there is deep skepticism that the Government will ever be allowed to run out of money and stop paying its bills.

~

• Debt Limit Increase Is Sought (October 19, 1989)

“The Treasury Department has formally notified Congress that it would like to have an increase in the national debt ceiling in place by Oct. 24 to permit planning for Treasury bond auctions and avoid a default on Government obligations when the current ceiling expires on Oct. 31.

Some House Democrats fear that the Administration is trying to create an artificial need for a short-term increase of the debt ceiling, to which Senate supporters of a capital gains tax cut could attach their proposal.”

~

• U.S. Sales Contingent on New Debt Ceiling (October 8, 1990)

Treasury financings this holiday-shortened week are confined to tomorrow’s auction of three- and six-month bills and Wednesday’s auction of seven-year notes.

On Thursday, the Resolution Funding Corporation, the agency established to raise money to finance the savings and loan bailout, will auction 30-year bonds. These auctions, however, are contingent on a new debt-ceiling increase being enacted.

The rate for a three-month bill on Friday was 7.04 percent and for a six-month bill it was 7.08 percent. By late in the day the outstanding seven-year note was trading at a price to yield 8.50 percent.

~

• Debt Ceiling Impasse Dampens Bond Prices (November 11, 1995)

Discussing the possibility of a Government default, Mr. Gamba said, “I believe that the repercussions would far exceed anyone’s estimation.” But, he added: “I don’t believe the Government would allow that to take place. It’s really hard to say how the market would react, because it’s never happened.”

Carroll J. Delaney, director of research at Stires, O’Donnell & Company, called the impasse between Congress and the Administration macho theatrics that were being played to the hilt. Still, he saw a potential for both a “loss of credibility and a significant decline in prices.”

Mr. Delaney said that the “procrastination and posturing is negative for both the markets and national image in the long run.”

He added that if “the Treasury pulls out all stops to insure timely payment on principal and interest,” there will be a short-term, temporary effect of uninvested cash looking for a home.

~

BATTLE OVER THE BUDGET: THE OVERVIEW;PRESIDENT VETOES STOPGAP BUDGET; SHUTDOWN LOOMS (November 11, 1995)

“President Clinton on Monday vetoed two bills intended to keep the Government in business as he and Republican leaders exchanged accusations of partisan irresponsibility and much of the Government prepared to shut down later today.

A last-ditch effort to reach agreement ended shortly before midnight without any progress between Mr. Clinton and Republican leaders. While Bob Dole of Kansas, the Senate majority leader, called the 90-minute session “constructive,” he said, “We went around and around, but we don’t have an agreement.” Senator Thomas A. Daschle of South Dakota, the Democratic leader, was even more emphatic, saying, “No progress was made.”

While other Republicans will meet with Administration officials later today, the failure to agree meant that about 800,000 Federal workers will be furloughed after reporting to work this morning.”

~

Gingrich Promises Solution on Debt Ceiling (1996)

Speaker Newt Gingrich promised today to avoid more uncertainty about the nation’s borrowing during the impasse on the Federal budget, saying, “We will find a way to take care of the debt ceiling.”

Mr. Gingrich, a Georgia Republican, made the comment at a news conference here and left immediately for the next stop on a 10-day fund-raising tour for Republicans.

The nation’s debt reached the statutory limit of $4.9 trillion on Nov. 15, and since then Treasury Secretary Robert E. Rubin has avoided defaulting on bonds by borrowing from Government pension funds, a practice that does not count against the debt ceiling.

~

• G.O.P. Strategy On Debt Ceiling (March 1, 2002)

Republican leaders in the House told the Bush administration that they did not have enough votes to increase the legal limit on the national debt and urged the White House to attach the measure to another piece of popular legislation, possibly a supplemental military appropriations bill. The administration has asked Congress to raise the debt limit by $750 billion, to $6.7 trillion, by the end of March, when the government is likely to breach the limit. Richard W. Stevenson

~

• Bush Seeks Increase in National Debt Limit (December 25, 2002)

The Bush administration asked Congress today to approve another increase in the limit on national debt, saying it will run out of the authority to borrow money by late February.

The deputy Treasury secretary, Kenneth W. Dam, in a letter to the House speaker, J. Dennis Hastert, cited the cost of combating terrorism and the economic slowdown for the government’s growing indebtedness.

The federal government, which enjoyed a budget surplus as recently as two years ago, had a shortfall of $157 billion this year and is expected to have a larger one in 2003.

Congress raised the government’s debt limit in July by $450 billion, to a total of $6.4 trillion, but administration officials predicted even then that they would need to raise the limit again by some time next year.

• As U.S. Debt Ceiling Is Reached, Bush Administration Seeks to Raise It Once Again (October 15, 2004)

Less than a day after President Bush implied that Senator John Kerry lacked ”fiscal sanity,” the Bush administration said on Thursday that the federal government had hit the debt ceiling set by Congress and would have to borrow from the civil service retirement system until after the elections.

Federal operations are unlikely to be affected because Congress is certain to raise the debt limit in a lame-duck session in November. Congressional Republicans had wanted to avoid an embarrassing vote to raise the debt ceiling just a few weeks before Election Day.

Since Mr. Bush took office in January 2001, the federal debt has increased about 40 percent, or $2.1 trillion, to $7.4 trillion. Congress has raised the debt ceiling three times in three years, raising it most recently by $984 billion in May 2003.

~

• Senate Approves Budget, Breaking Spending Limits (March 16, 2006)

The Senate narrowly approved a $2.8 trillion election-year budget Thursday that broke spending limits only hours after it increased federal borrowing power to avert a government default.

The budget decision at the end of a marathon day of voting followed a separate 52-to-48 Senate vote to increase the federal debt limit by $781 billion, bringing the debt ceiling to nearly $9 trillion. The move left Democrats attacking President Bush and Congressional Republicans for piling up record debt in their years in power.~

• Bush signs sweeping housing bill (July 30, 2008)

President George W. Bush signed into law on Wednesday a huge package of housing legislation that included broad authority for the Treasury Department to safeguard the nation’s two largest mortgage finance companies and a plan to help hundreds of thousands of troubled borrowers avoid losing their homes.

The law authorizes the Treasury to rescue the mortgage finance giants, Fannie Mae and Freddie Mac, should they verge on collapse, potentially by spending tens of billions in federal monies. Together, the companies own or guarantee nearly half of the nation’s $12 trillion in mortgages.

To accommodate the rescue plan for the mortgage companies, the bill raises the national debt ceiling to $10.6 trillion, an increase of $800 billion. The bill also creates significant liabilities and risks for taxpayers, that are virtually impossible to calculate.

~~~

Excel Spreadsheet (hist07z3) via WhiteHouse.gov

What's been said:

Discussions found on the web: