Earlier this week, we looked at the impact the financials had on the S&P. Today, I want to bring two charts to your attention that might give you some pause.

The first is from Ron Griess (The Chart Store), showing NYSE market cap as a percentage of GDP. It indirectly relates stock prices and valuation to 0verall US economic activity. This acts as a ratio: How active are bankers, speculators, traders, etc. relative to other activity?

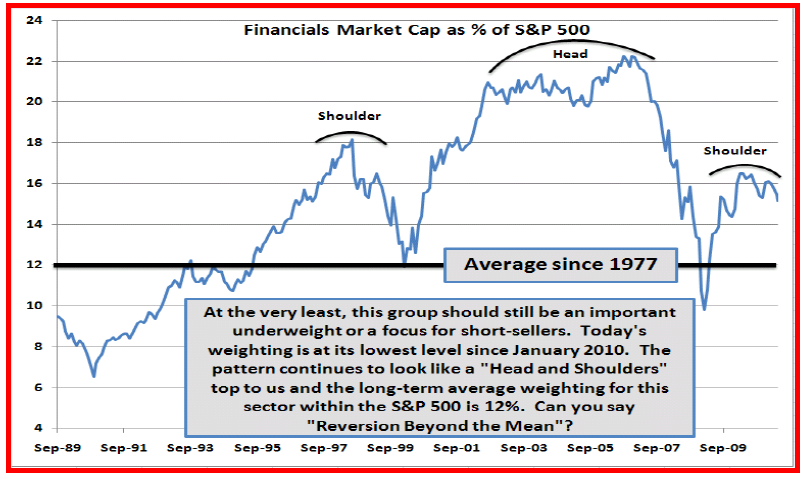

A more direct version comes from John Roque of WJB Capital. John took the market capitalization of the Financials versus the SPX cap. You can readily see how far above the median we have been since the mid-1990s. (I can only partially blame Alan Greenspan’s easy money for this).

Combine these two charts, and you get a sense of what happens when Finance is dominant versus other sectors.

>

NYSE Market Cap vs Nominal GDP

>

What's been said:

Discussions found on the web: