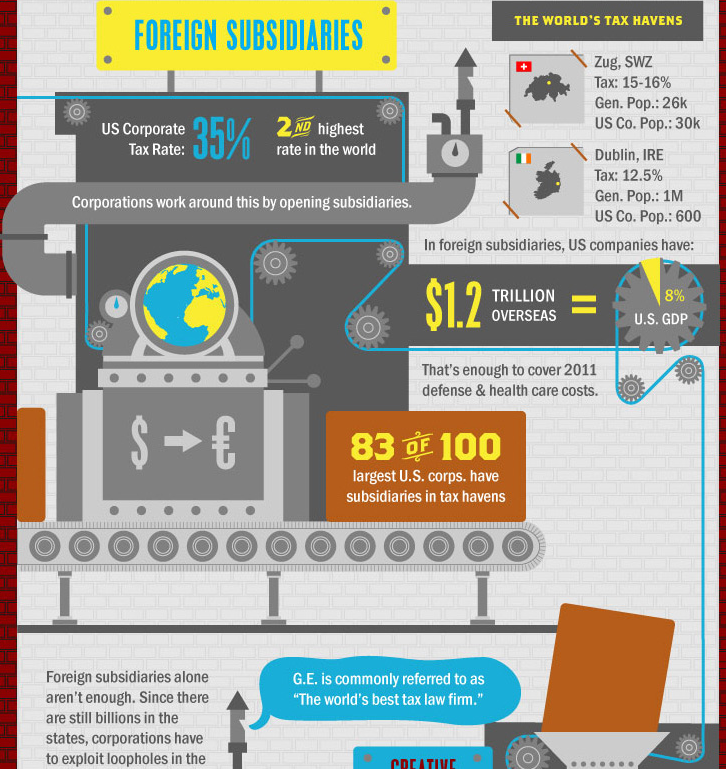

This is the first third of the graphic; click for larger graphic

Online MBA hat tip Business Pundit

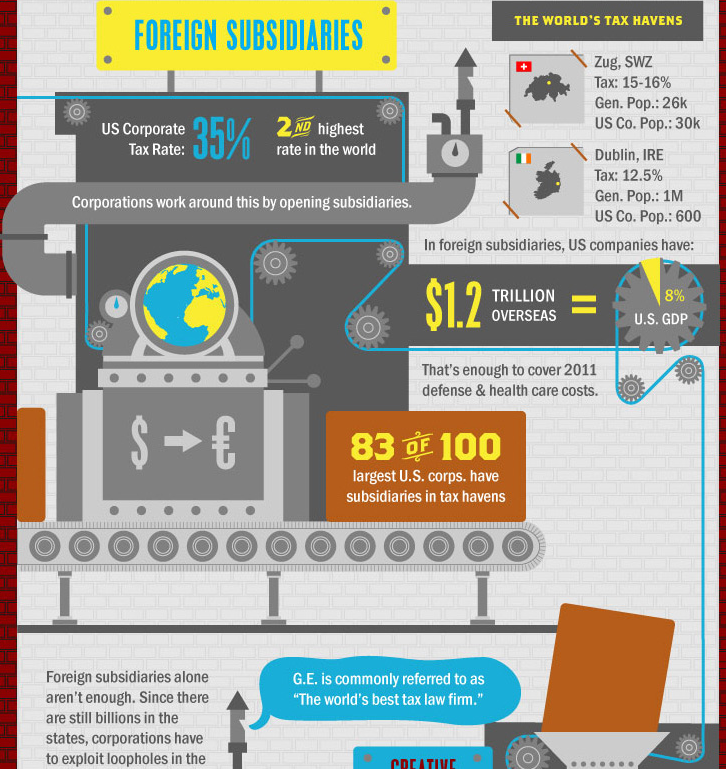

This is the first third of the graphic; click for larger graphic

Online MBA hat tip Business Pundit

Get subscriber-only insights and news delivered by Barry every two weeks.

What's been said:

Discussions found on the web: